Globalization of Legal Services

The globalization of legal services is a significant driver of the legal process-outsourcing market, as firms seek to expand their reach and serve clients across borders. This trend is particularly relevant in the US, where law firms are increasingly collaborating with international partners to provide comprehensive legal solutions. The ability to tap into diverse legal expertise and resources enhances service delivery and client satisfaction. As firms navigate complex international regulations, the demand for outsourced legal services is likely to rise, fostering growth in the legal process-outsourcing market. This globalization trend may also lead to increased competition among service providers.

Cost Efficiency and Resource Allocation

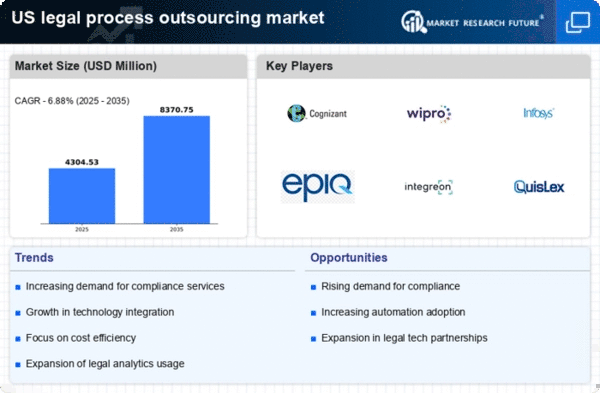

The legal process-outsourcing market is increasingly driven by the need for cost efficiency among law firms and corporate legal departments. By outsourcing legal tasks, organizations can reduce operational costs by up to 30%, allowing them to allocate resources more effectively. This trend is particularly pronounced in the US, where firms face pressure to maintain profitability while managing rising overhead costs. The ability to access specialized legal services at a fraction of the cost of in-house operations enhances competitiveness. As a result, the legal process-outsourcing market is expected to grow, with firms seeking to optimize their budgets and improve service delivery without compromising quality.

Focus on Risk Mitigation and Compliance

The legal process outsourcing market is significantly influenced by a heightened focus on risk mitigation and compliance among organizations. As regulatory frameworks become more complex, businesses are compelled to ensure adherence to legal standards, which often necessitates external expertise. In the US, companies are increasingly outsourcing compliance-related tasks to specialized providers, thereby reducing the risk of legal penalties. This trend is expected to drive growth in the legal process-outsourcing market, as firms recognize the importance of maintaining compliance while managing operational risks. The ability to access expert knowledge in compliance matters enhances organizational resilience.

Increased Demand for Specialized Services

The legal process-outsourcing market is witnessing a surge in demand for specialized legal services, driven by the complexity of legal issues and the need for expertise in niche areas. As businesses navigate intricate regulatory environments, they increasingly seek external providers who can offer tailored solutions. This trend is particularly evident in sectors such as healthcare and finance, where compliance requirements are stringent. The market for legal process outsourcing is projected to expand as firms recognize the value of leveraging specialized knowledge to enhance their service offerings. This shift not only improves efficiency but also mitigates risks associated with legal compliance.

Technological Advancements in Legal Services

Technological advancements are reshaping the legal process-outsourcing market, enabling firms to leverage innovative tools for improved efficiency and accuracy. Automation, artificial intelligence, and data analytics are becoming integral to legal operations, allowing for faster document review and case management. In the US, the adoption of these technologies is expected to increase by 25% over the next few years, as firms seek to enhance productivity and reduce turnaround times. This technological integration not only streamlines processes but also positions legal service providers to offer more competitive pricing, thereby driving growth in the legal process-outsourcing market.