Focus on Enhanced Customer Experience

The The market is increasingly shaped by the focus on enhancing customer experience in dining establishments. As consumers become more discerning, restaurants are compelled to adopt technologies that improve service delivery and satisfaction. Kitchen display systems play a crucial role in this regard by ensuring that orders are processed accurately and efficiently. The ability to track order status in real-time allows staff to provide timely updates to customers, thereby improving overall dining experiences. Research indicates that establishments that prioritize customer experience can see an increase in repeat business by as much as 30%, highlighting the strategic importance of kitchen display systems in fostering customer loyalty.

Rising Demand for Operational Efficiency

The The market is significantly influenced by the rising demand for operational efficiency among food service establishments. As competition intensifies, restaurants are increasingly focused on optimizing their kitchen workflows to reduce wait times and enhance customer satisfaction. The integration of kitchen display systems facilitates real-time communication between the front and back of the house, minimizing errors and improving order accuracy. Data suggests that establishments utilizing these systems can reduce food preparation times by up to 20%. This efficiency not only boosts productivity but also contributes to higher profit margins, making kitchen display systems a vital investment for modern food service operations.

Growing Emphasis on Food Safety and Compliance

The The market is also influenced by the growing emphasis on food safety and compliance within the food service industry. Regulatory requirements regarding food handling and preparation are becoming increasingly stringent, prompting establishments to adopt systems that ensure adherence to safety standards. Kitchen display systems can assist in monitoring food preparation processes, thereby reducing the risk of contamination and ensuring compliance with health regulations. Data shows that restaurants implementing these systems can decrease food safety violations by up to 25%. This focus on safety not only protects consumers but also enhances the reputation of food service providers, making kitchen display systems an essential component of modern kitchen operations.

Shift Towards Digital Solutions in Food Service

The The market is witnessing a notable shift towards digital solutions as food service providers embrace technology to enhance their operations. The increasing reliance on digital platforms for order management and customer interaction is driving the adoption of kitchen display systems. This transition is further supported by the growing trend of online food ordering, which necessitates efficient kitchen management to fulfill orders promptly. Market analysis indicates that the digital transformation in the food service sector is expected to reach a valuation of $50 billion by 2027, underscoring the importance of kitchen display systems in meeting the demands of a tech-savvy consumer base.

Technological Advancements in Kitchen Display Systems

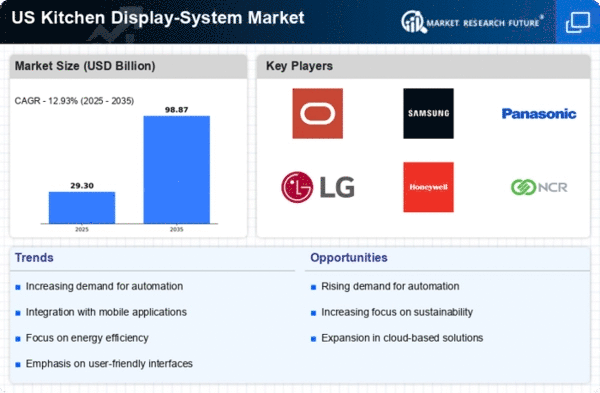

The kitchen display-system market is experiencing a surge due to rapid technological advancements. Innovations such as high-definition displays, touch-screen interfaces, and real-time data analytics are enhancing operational efficiency in kitchens. These advancements allow for seamless integration with point-of-sale systems, which is crucial for streamlining order management. According to recent data, the market is projected to grow at a CAGR of 10.5% from 2025 to 2030, driven by the increasing demand for efficient kitchen operations. As restaurants and food service providers seek to improve service speed and accuracy, the adoption of advanced kitchen display systems becomes imperative. This trend indicates a shift towards more sophisticated solutions that cater to the evolving needs of the food service industry.