Changing Consumer Preferences

The Virtual Kitchen Market is significantly influenced by changing consumer preferences towards healthier and diverse food options. As awareness of nutrition and dietary choices increases, consumers are gravitating towards meals that align with their health goals. This shift is evident in the rising demand for plant-based and organic meal options, which have seen a growth rate of approximately 20% in recent years. Virtual kitchens are adapting to these preferences by offering customizable menus that cater to various dietary needs. This responsiveness to consumer demands not only enhances customer satisfaction but also positions the Virtual Kitchen Market as a key player in the evolving food landscape. By embracing these trends, virtual kitchens can attract a broader customer base and foster brand loyalty.

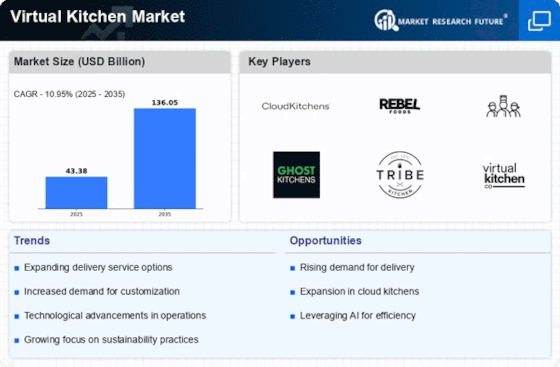

Expansion of Delivery Services

The expansion of delivery services is a crucial driver for the Virtual Kitchen Market. As consumers increasingly prefer dining at home, the demand for efficient and reliable food delivery options has surged. Partnerships with third-party delivery platforms have become commonplace, allowing virtual kitchens to reach a wider audience without the need for extensive marketing. This trend is supported by data indicating that food delivery services have grown by over 25% in recent years. The convenience of having meals delivered directly to consumers' doorsteps enhances the appeal of virtual kitchens, positioning them as a viable alternative to traditional dining experiences. As delivery services continue to expand, the Virtual Kitchen Market is likely to see sustained growth and innovation.

Increased Demand for Convenience

The Virtual Kitchen Market experiences a notable surge in demand for convenience-driven food solutions. As consumers increasingly seek quick and hassle-free meal options, the appeal of delivery-only kitchens becomes more pronounced. This trend is reflected in the growing number of virtual kitchen establishments, which reportedly increased by over 30% in the last year. The rise of mobile applications and online platforms facilitates seamless ordering, further enhancing consumer accessibility. Consequently, the Virtual Kitchen Market is poised for expansion as it caters to the evolving preferences of time-constrained individuals and families. This shift towards convenience is likely to drive innovation in menu offerings and service delivery, ultimately reshaping the culinary landscape.

Cost Efficiency and Lower Overheads

Cost efficiency is a driving force behind the growth of the Virtual Kitchen Market. By eliminating the need for traditional dining spaces, virtual kitchens can significantly reduce overhead costs associated with rent, utilities, and staffing. This model allows operators to allocate resources more effectively, focusing on food quality and marketing efforts. Reports indicate that virtual kitchens can operate with up to 50% lower costs compared to conventional restaurants. This financial advantage enables them to offer competitive pricing, attracting price-sensitive consumers. As the market continues to evolve, the emphasis on cost efficiency may encourage more entrepreneurs to enter the Virtual Kitchen Market, fostering innovation and competition.

Technological Advancements in Food Preparation

Technological advancements play a pivotal role in shaping the Virtual Kitchen Market. Innovations in kitchen equipment, such as automated cooking systems and smart appliances, enhance operational efficiency and food quality. These technologies enable virtual kitchens to streamline their processes, reduce preparation times, and maintain consistency in food offerings. Moreover, data analytics tools allow operators to optimize inventory management and predict consumer preferences, thereby minimizing waste. The integration of technology not only improves the overall customer experience but also positions the Virtual Kitchen Market as a forward-thinking sector. As these technologies continue to evolve, they may further transform how food is prepared and delivered, potentially leading to new business models and revenue streams.