Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the IVD Contract-Manufacturing Market, as companies seek to optimize their operations. By outsourcing manufacturing processes, firms can significantly reduce overhead costs and allocate resources more effectively. This trend is particularly relevant in the context of rising production costs and the need for competitive pricing in the diagnostic sector. A recent analysis indicates that outsourcing can lead to cost savings of up to 30%, making it an attractive option for many companies. Consequently, the emphasis on cost efficiency is likely to propel the growth of the ivd contract-manufacturing market, as businesses prioritize financial sustainability.

Regulatory Landscape Adaptation

The regulatory environment surrounding the IVD Contract-Manufacturing Market is continually evolving, necessitating adaptability from manufacturers. Compliance with stringent regulations set forth by agencies such as the FDA is essential for market participants. Companies that can navigate these complex regulatory frameworks effectively are better positioned to succeed. The increasing focus on quality assurance and risk management in manufacturing processes is indicative of this trend. As firms invest in compliance strategies, the overall integrity and reliability of the ivd contract-manufacturing market are enhanced, fostering trust among stakeholders and consumers alike.

Innovation in Product Development

Innovation plays a crucial role in the IVD Contract-Manufacturing Market, as companies strive to develop advanced diagnostic solutions. The integration of cutting-edge technologies, such as artificial intelligence and machine learning, is transforming product development processes. These innovations not only improve the accuracy and speed of diagnostics but also reduce costs associated with manufacturing. As a result, companies are increasingly seeking contract manufacturers that can provide specialized expertise and state-of-the-art facilities. This trend is expected to drive growth in the ivd contract-manufacturing market, as firms look to leverage innovative solutions to stay competitive in a rapidly evolving landscape.

Emergence of Personalized Medicine

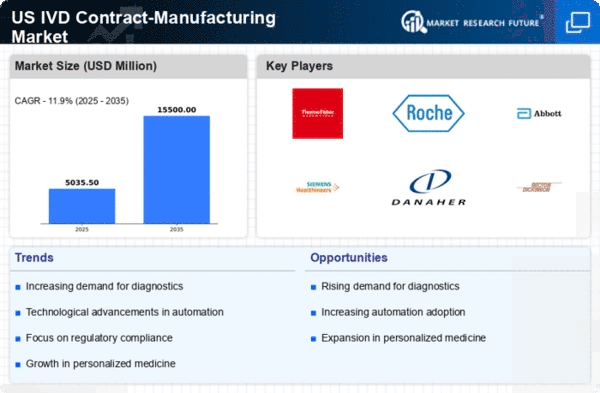

The rise of personalized medicine is reshaping the landscape of the IVD Contract-Manufacturing Market. As healthcare shifts towards tailored treatment approaches, the demand for specific diagnostic tests that cater to individual patient needs is increasing. This trend necessitates the development of specialized manufacturing processes capable of producing customized diagnostic solutions. The market for personalized medicine is expected to grow significantly, with estimates suggesting a CAGR of over 10% in the coming years. This growth presents opportunities for contract manufacturers to expand their offerings and capabilities, thereby driving innovation and competitiveness within the ivd contract-manufacturing market.

Rising Demand for Diagnostic Testing

The increasing prevalence of chronic diseases and the aging population in the US are driving the demand for diagnostic testing. This trend is particularly evident in the IVD Contract-Manufacturing Market, where the need for rapid and accurate testing solutions is paramount. According to recent data, the market for in vitro diagnostics is projected to reach approximately $30 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5%. This surge in demand necessitates robust contract manufacturing capabilities to meet the needs of diagnostic companies, thereby enhancing the overall efficiency and effectiveness of the ivd contract-manufacturing market.