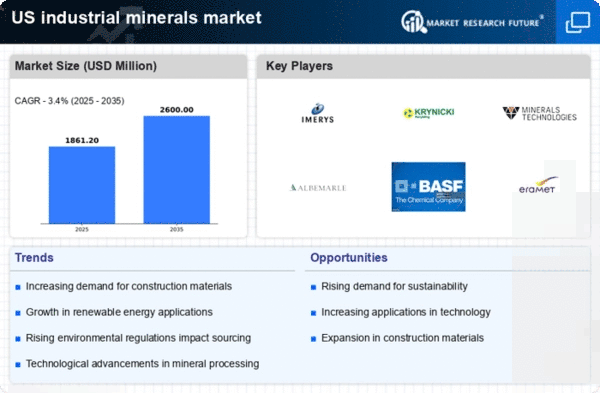

The industrial minerals market in the US is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Imerys (FR), Minerals Technologies Inc (US), and Albemarle Corporation (US) are actively pursuing strategies that emphasize technological advancement and operational efficiency. Imerys (FR) focuses on enhancing its product portfolio through innovation, while Minerals Technologies Inc (US) is leveraging its expertise in specialty minerals to cater to diverse industrial applications. Albemarle Corporation (US) is strategically positioned in the lithium market, which is integral to the growing demand for electric vehicle batteries, thus aligning its operations with broader market trends.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on sustainability initiatives. This collective influence of key players fosters a competitive environment where innovation and operational excellence are paramount.

In September Imerys (FR) announced a partnership with a leading technology firm to develop advanced materials for the renewable energy sector. This strategic move is likely to enhance Imerys' position in the market by aligning its product offerings with the increasing demand for sustainable energy solutions. The collaboration may also facilitate access to new technologies, thereby improving operational efficiencies and product performance.

In October Minerals Technologies Inc (US) launched a new line of eco-friendly minerals aimed at reducing environmental impact in construction applications. This initiative underscores the company's commitment to sustainability and positions it favorably in a market that is progressively prioritizing environmentally responsible practices. The introduction of these products could potentially attract a broader customer base seeking sustainable alternatives.

In August Albemarle Corporation (US) expanded its lithium production capacity in response to the surging demand for electric vehicle batteries. This expansion is strategically significant as it not only enhances Albemarle's market share but also reinforces its commitment to supporting the transition to electric mobility. The increased capacity may provide a competitive edge in a rapidly evolving market landscape.

As of November the competitive trends in the industrial minerals market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing supply chain reliability. The shift from price-based competition to a focus on technological advancement and sustainable practices is likely to shape the future of the market, with companies that prioritize innovation and operational excellence poised to lead the way.