Growing Workforce Skills Gap

The growing workforce skills gap is emerging as a critical driver for the industrial automation-services market. As industries increasingly adopt advanced automation technologies, there is a pressing need for skilled workers who can operate and maintain these systems. This skills gap poses challenges for organizations, prompting them to invest in training and development programs. According to estimates, nearly 2 million manufacturing jobs could remain unfilled due to the lack of qualified candidates by 2028. Consequently, the industrial automation-services market is likely to expand as companies seek external services to bridge this skills gap and ensure effective implementation of automation solutions.

Rising Demand for Efficiency

The industrial automation-services market is experiencing a notable surge in demand for efficiency across various sectors. Companies are increasingly seeking to optimize their operations, reduce waste, and enhance productivity. This trend is driven by the need to remain competitive in a rapidly evolving marketplace. According to recent data, organizations that implement automation solutions can achieve efficiency gains of up to 30%. As a result, the industrial automation-services market is projected to grow significantly, with an estimated value reaching $200 billion by 2026. This growth is indicative of a broader shift towards automation as a means to streamline processes and improve overall operational performance.

Expansion of Smart Manufacturing

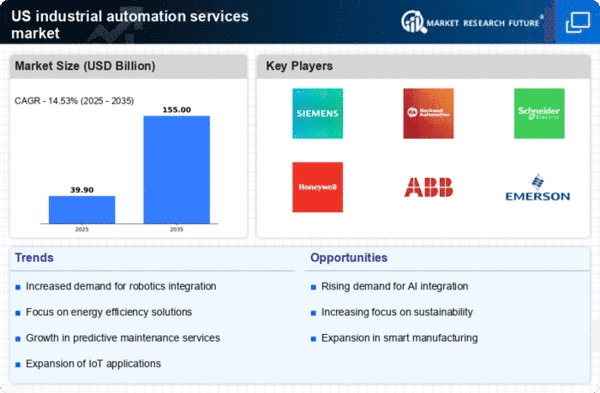

The expansion of smart manufacturing is significantly influencing the industrial automation-services market. The integration of IoT, big data analytics, and cloud computing is enabling manufacturers to create interconnected systems that enhance decision-making and operational efficiency. This trend is characterized by real-time data collection and analysis, allowing for predictive maintenance and improved supply chain management. The smart manufacturing market is projected to reach $500 billion by 2027, indicating a robust growth trajectory. As more companies adopt these technologies, the industrial automation-services market is likely to see increased demand for services that support smart manufacturing initiatives.

Increased Focus on Sustainability

the industrial automation-services market is experiencing a growing emphasis on sustainability as organizations strive to minimize their environmental impact. Companies are increasingly adopting automation solutions that promote energy efficiency and reduce carbon emissions. This shift is not only driven by regulatory requirements but also by consumer demand for sustainable practices. For instance, automation technologies can optimize energy consumption in manufacturing processes, leading to reductions in energy costs by up to 20%. As sustainability becomes a core business strategy, the industrial automation-services market is expected to benefit from increased investments in green technologies and practices.

Technological Advancements in Robotics

Technological advancements in robotics are playing a pivotal role in shaping the industrial automation-services market. Innovations in robotic systems, including collaborative robots (cobots) and autonomous mobile robots (AMRs), are enhancing operational capabilities across industries. These advancements enable businesses to automate complex tasks, improve precision, and reduce labor costs. The market for industrial robots is projected to grow at a CAGR of 10% from 2025 to 2030, reflecting the increasing adoption of robotic solutions. As companies integrate these technologies, the industrial automation-services market is likely to expand, driven by the need for more sophisticated and efficient automation solutions.