Emerging Trends in Combination Therapies

The trend towards combination therapies in the treatment of autoimmune diseases and transplant rejection is emerging as a key driver for the immunosuppressive drugs market. Healthcare professionals are increasingly recognizing the benefits of using multiple drugs to achieve better therapeutic outcomes. This approach can enhance efficacy while potentially reducing side effects associated with high doses of single agents. As a result, pharmaceutical companies are likely to focus on developing combination therapies that incorporate existing immunosuppressive drugs with novel agents. This shift in treatment paradigms may lead to a broader range of options for patients, thereby stimulating growth in the immunosuppressive drugs market.

Growing Prevalence of Autoimmune Diseases

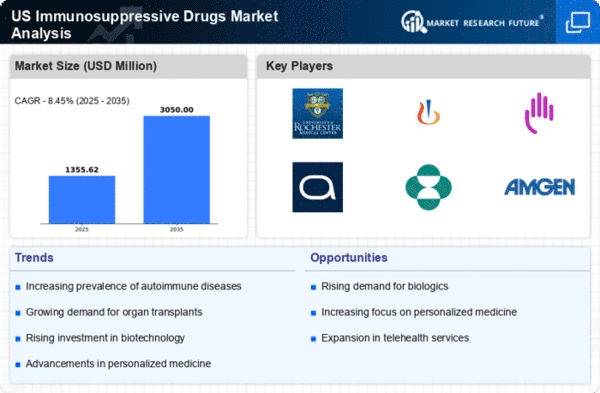

The rising incidence of autoimmune diseases in the US is a primary driver for the immunosuppressive drugs market. Conditions such as rheumatoid arthritis, lupus, and multiple sclerosis are becoming increasingly common, affecting millions of individuals. According to recent estimates, autoimmune diseases impact approximately 5-8% of the US population, leading to a heightened demand for effective treatment options. This trend is likely to continue, as the aging population is more susceptible to these conditions. Consequently, pharmaceutical companies are focusing on developing innovative immunosuppressive therapies to address this growing need. The increasing prevalence of these diseases not only drives market growth but also encourages research and development efforts aimed at improving patient outcomes in the immunosuppressive drugs market.

Advancements in Drug Development Technologies

Technological advancements in drug development are significantly influencing the immunosuppressive drugs market. Innovations such as high-throughput screening, bioinformatics, and advanced drug delivery systems are streamlining the research and development process. These technologies enable faster identification of potential drug candidates and enhance the efficacy of existing therapies. For instance, the integration of artificial intelligence in drug discovery is expected to reduce development timelines and costs, potentially leading to a more robust pipeline of immunosuppressive drugs. As a result, pharmaceutical companies are likely to invest heavily in these technologies, which could lead to a surge in new product launches and an expansion of the immunosuppressive drugs market.

Rising Investment in Healthcare Infrastructure

The increasing investment in healthcare infrastructure in the US is positively impacting the immunosuppressive drugs market. Enhanced healthcare facilities and improved access to medical services are facilitating better diagnosis and treatment of conditions requiring immunosuppressive therapy. Government initiatives aimed at expanding healthcare access, particularly in underserved areas, are likely to contribute to market growth. Furthermore, the establishment of specialized clinics and treatment centers for autoimmune diseases and organ transplantation is expected to drive demand for immunosuppressive drugs. As healthcare infrastructure continues to evolve, the immunosuppressive drugs market may experience a corresponding increase in utilization and sales.

Increasing Awareness and Diagnosis of Transplantation Needs

The growing awareness regarding organ transplantation and the need for immunosuppressive therapy is a significant driver for the immunosuppressive drugs market. As more individuals become informed about the benefits of organ transplants, the demand for immunosuppressive drugs to prevent organ rejection is likely to rise. In the US, the number of organ transplants has been steadily increasing, with over 39,000 transplants performed in 2020 alone. This trend is expected to continue, as advancements in surgical techniques and post-operative care improve transplant success rates. Consequently, the immunosuppressive drugs market is poised for growth, as healthcare providers seek effective therapies to support transplant recipients.