Advancements in Communication Technologies

Advancements in communication technologies are significantly impacting the US Iiot Gateway For Utility Market. The evolution of wireless communication standards, such as 5G, is enhancing the capabilities of IIoT gateways, allowing for faster and more reliable data transmission. This technological progress enables utilities to implement more sophisticated monitoring and control systems, improving grid management and operational efficiency. As utilities adopt these advanced communication technologies, the market for IIoT gateways is likely to expand, with projections indicating a growth rate of approximately 12% annually. The ability to leverage high-speed communication will be crucial for utilities aiming to optimize their operations and enhance service delivery.

Growing Demand for Real-Time Data Analytics

The demand for real-time data analytics is a pivotal driver in the US Iiot Gateway For Utility Market. Utilities are increasingly recognizing the value of data-driven decision-making to enhance operational efficiency and customer satisfaction. IIoT gateways facilitate the collection and analysis of vast amounts of data from various sources, enabling utilities to monitor grid performance and predict maintenance needs. According to recent studies, utilities that leverage real-time analytics can reduce operational costs by up to 20%. This trend is likely to accelerate as more utilities invest in IIoT technologies to harness the power of data analytics, thereby fostering growth in the market.

Regulatory Support for Smart Grid Initiatives

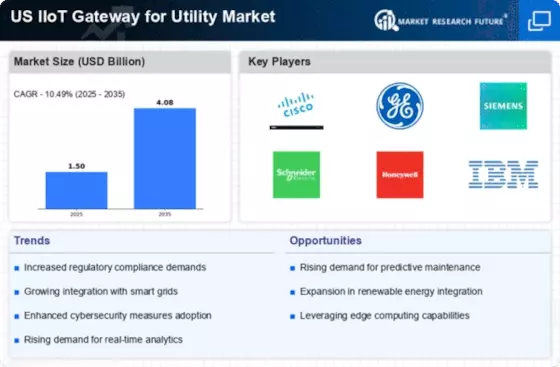

The US Iiot Gateway For Utility Market is experiencing a surge in regulatory support aimed at enhancing smart grid initiatives. Federal and state policies are increasingly promoting the integration of advanced technologies to improve energy efficiency and reliability. For instance, the Federal Energy Regulatory Commission (FERC) has implemented regulations that encourage utilities to adopt smart grid technologies, which include IIoT gateways. This regulatory environment is expected to drive investments in IIoT solutions, as utilities seek to comply with mandates while optimizing their operations. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, driven by these supportive policies.

Increased Investment in Infrastructure Modernization

Infrastructure modernization is a critical driver for the US Iiot Gateway For Utility Market. As aging infrastructure poses challenges to reliability and efficiency, utilities are compelled to invest in modern solutions. The US government has allocated substantial funding for infrastructure upgrades, including smart grid technologies that incorporate IIoT gateways. For example, the Infrastructure Investment and Jobs Act has earmarked billions for energy infrastructure improvements. This influx of capital is expected to stimulate the adoption of IIoT solutions, as utilities seek to enhance their operational capabilities and meet the demands of a modern energy landscape. The market is poised for growth as these investments materialize.

Rising Focus on Sustainability and Environmental Compliance

Sustainability and environmental compliance are increasingly influencing the US Iiot Gateway For Utility Market. Utilities are under pressure to reduce their carbon footprints and comply with stringent environmental regulations. IIoT gateways play a vital role in enabling utilities to monitor emissions and optimize energy consumption. The integration of renewable energy sources, such as solar and wind, further necessitates the use of IIoT technologies to manage grid stability and efficiency. As utilities strive to meet sustainability goals, the demand for IIoT solutions is expected to rise, potentially leading to a market expansion of over 15% in the next few years, as they align with environmental standards.