North America : Market Leader in IIoT Services

North America is poised to maintain its leadership in the Industrial IoT (IIoT) Equipment Repair Services Market, holding a significant market share of 7.5 in 2024. The region's growth is driven by rapid technological advancements, increased automation in manufacturing, and a strong focus on predictive maintenance. Regulatory support for smart manufacturing initiatives further catalyzes demand, ensuring that industries remain competitive and efficient.

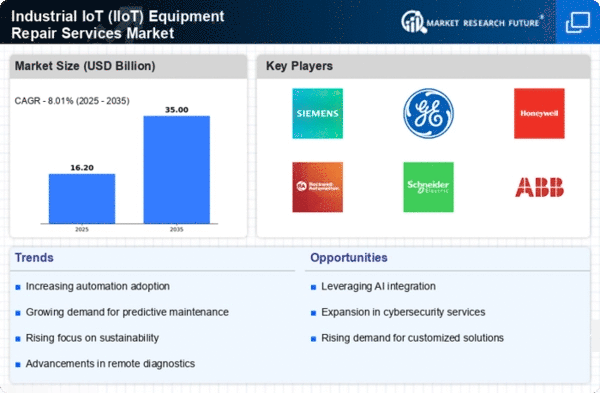

The competitive landscape in North America is robust, featuring key players such as Siemens, General Electric, and Honeywell. These companies are investing heavily in R&D to enhance service offerings and integrate advanced analytics into repair services. The U.S. stands out as a leader, with a well-established infrastructure and a high adoption rate of IIoT technologies, making it a fertile ground for innovation and growth.

Europe : Emerging Hub for IIoT Solutions

Europe is rapidly evolving as a significant player in the Industrial IoT (IIoT) Equipment Repair Services Market, with a market size of 4.5 in 2024. The region benefits from stringent regulations aimed at enhancing operational efficiency and sustainability, driving demand for advanced repair services. The European Union's commitment to digital transformation and Industry 4.0 initiatives further supports market growth, encouraging investments in smart technologies and infrastructure.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, hosting major players like Siemens and Schneider Electric. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for market share. The presence of a skilled workforce and strong governmental support for technological advancements positions Europe as a key player in the global IIoT landscape.

Asia-Pacific : Rapidly Growing IIoT Market

Asia-Pacific is witnessing a surge in the Industrial IoT (IIoT) Equipment Repair Services Market, with a market size of 2.5 in 2024. The region's growth is fueled by increasing industrial automation, rising demand for smart manufacturing solutions, and government initiatives promoting digitalization. Countries like China and Japan are leading the charge, investing heavily in IIoT technologies to enhance operational efficiency and reduce downtime.

The competitive landscape is diverse, with both local and international players such as Mitsubishi Electric and ABB making significant inroads. The presence of a large manufacturing base and a growing emphasis on predictive maintenance solutions are key drivers of market expansion. As industries in the region continue to adopt IIoT technologies, the demand for specialized repair services is expected to rise significantly, creating new opportunities for growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is gradually emerging in the Industrial IoT (IIoT) Equipment Repair Services Market, with a market size of 0.5 in 2024. The growth is primarily driven by increasing investments in infrastructure and a growing focus on digital transformation across various industries. Governments in the region are recognizing the importance of IIoT in enhancing operational efficiency and are implementing policies to support technological advancements.

Countries like South Africa and the UAE are leading the way, with initiatives aimed at fostering innovation and attracting foreign investment. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As industries in the MEA region continue to evolve, the demand for IIoT repair services is expected to grow, driven by the need for improved efficiency and reduced operational costs.