Rising Healthcare Expenditure

The upward trend in healthcare spending in the United States is another driver for the hemorrhoid treatment-devices market. As individuals allocate more resources towards health and wellness, there is a corresponding increase in the demand for effective treatment options. The U.S. healthcare expenditure is projected to reach $4 trillion by 2026, with a significant portion directed towards outpatient treatments, including those for hemorrhoids. This financial commitment indicates a willingness among consumers to invest in advanced treatment devices, thereby fostering growth in the hemorrhoid treatment-devices market. The market is likely to see a surge in new product introductions as companies respond to this increased spending.

Growing Awareness and Education

Increased awareness regarding hemorrhoid conditions and available treatment options is significantly influencing the hemorrhoid treatment-devices market. Educational campaigns by healthcare organizations and online platforms have empowered patients to seek timely treatment. This heightened awareness is likely to lead to earlier diagnoses and increased utilization of treatment devices. As patients become more informed about their options, the demand for effective hemorrhoid treatment devices is expected to rise. Market analysts suggest that this trend could contribute to a growth rate of approximately 4% in the coming years, as more individuals actively pursue solutions for their symptoms.

Advancements in Medical Technology

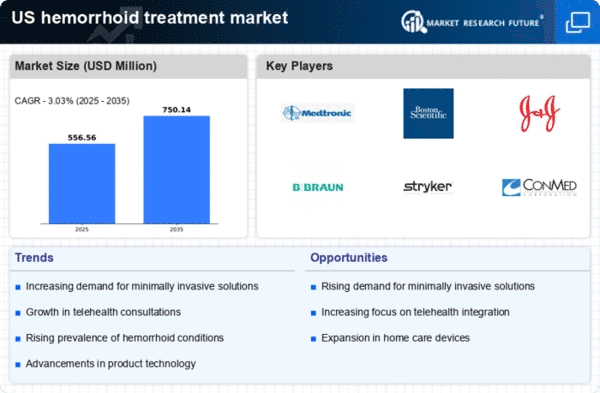

Technological innovations play a crucial role in shaping the hemorrhoid treatment-devices market. The introduction of minimally invasive devices, such as rubber band ligators and infrared coagulation units, has transformed treatment approaches. These advancements not only enhance patient comfort but also improve recovery times, making them more appealing to both patients and healthcare providers. The market for these devices is projected to reach approximately $1 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 6%. As technology continues to evolve, the hemorrhoid treatment-devices market is expected to benefit from new product developments that offer greater efficacy and safety.

Shift Towards Home-Based Treatments

The trend towards home-based healthcare solutions is reshaping the hemorrhoid treatment-devices market. Patients increasingly prefer to manage their conditions at home, leading to a rise in demand for over-the-counter treatment devices. This shift is driven by the convenience and privacy associated with home treatments, as well as the desire to avoid hospital visits. Market data suggests that the home-use segment of the hemorrhoid treatment-devices market could grow by approximately 7% annually. As manufacturers develop user-friendly devices for home use, this segment is expected to expand, reflecting changing consumer preferences and the ongoing evolution of healthcare delivery.

Increasing Prevalence of Hemorrhoids

The rising incidence of hemorrhoids in the population is a primary driver for the hemorrhoid treatment-devices market. Factors such as sedentary lifestyles, poor dietary habits, and an aging population contribute to this trend. According to recent health statistics, approximately 50% of adults will experience hemorrhoids by the age of 50. This growing prevalence necessitates effective treatment options, thereby boosting demand for various hemorrhoid treatment devices. As more individuals seek relief from symptoms, the market is likely to expand, with an estimated growth rate of around 5% annually. This trend indicates a robust opportunity for manufacturers and healthcare providers to innovate and offer advanced treatment solutions in the hemorrhoid treatment-devices market.