Rising Healthcare Expenditure

Italy's increasing healthcare expenditure is a significant driver for the hemorrhoid treatment-devices market. As the government allocates more funds to healthcare, there is a greater emphasis on providing advanced medical technologies and treatment options. In recent years, healthcare spending has risen by approximately 4% annually, facilitating the introduction of new devices and treatments. This financial commitment allows for better access to innovative hemorrhoid treatment devices, which can lead to improved patient outcomes. Furthermore, as healthcare facilities upgrade their equipment, the demand for effective hemorrhoid treatment solutions is expected to rise, thereby fostering market growth.

Increasing Prevalence of Hemorrhoids

The rising incidence of hemorrhoids in Italy is a crucial driver for the hemorrhoid treatment-devices market. Factors such as an aging population and lifestyle changes contribute to this trend. According to health statistics, approximately 50% of adults experience hemorrhoids at some point in their lives. This growing prevalence necessitates effective treatment options, thereby boosting demand for innovative devices. As more individuals seek relief from symptoms, the market is likely to expand, with an increasing variety of treatment devices being developed to cater to diverse patient needs. The focus on improving quality of life for those affected by hemorrhoids further propels the market forward, indicating a robust growth trajectory in the coming years.

Advancements in Minimally Invasive Techniques

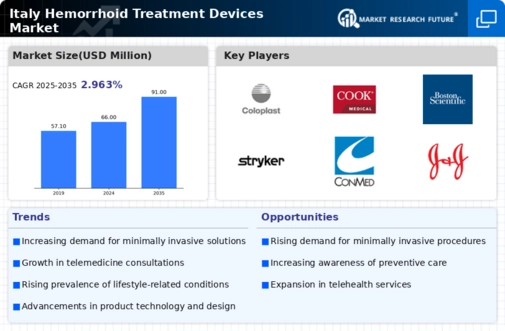

The shift towards minimally invasive procedures is significantly influencing the hemorrhoid treatment-devices market. Patients increasingly prefer treatments that offer reduced recovery times and lower risks of complications. Innovations in device technology, such as laser and radiofrequency treatments, are gaining traction. These advancements not only enhance patient comfort but also improve clinical outcomes. In Italy, the market for minimally invasive hemorrhoid treatments will be projected to grow at a CAGR of around 8% over the next five years. This trend reflects a broader movement within the healthcare sector towards less invasive options, which is likely to attract more patients seeking effective solutions for their conditions.

Enhanced Focus on Patient Education and Support

the emphasis on patient education and support is becoming increasingly relevant in the hemorrhoid treatment market. Healthcare providers are recognizing the importance of informing patients about their conditions and available treatment options. This focus on education is likely to lead to higher treatment adherence and better health outcomes. In Italy, initiatives aimed at improving patient knowledge about hemorrhoids and their management are gaining momentum. As patients become more informed, they are more likely to seek out effective treatment devices, thereby driving market growth. The integration of educational resources into treatment plans may also enhance patient satisfaction and overall experience.

Growing Demand for Home-Based Treatment Solutions

The trend towards home-based treatment solutions is reshaping the hemorrhoid treatment-devices market. Patients are increasingly seeking convenient options that allow them to manage their conditions from the comfort of their homes. This shift is driven by a desire for privacy and the avoidance of hospital visits. As a result, manufacturers are developing user-friendly devices that can be utilized at home, such as portable treatment kits and self-care products. This market segment is anticipated to grow significantly, with estimates suggesting a potential increase of 15% in demand over the next few years. The convenience and accessibility of home-based solutions are likely to attract a broader audience, further stimulating market expansion.