Rising Healthcare Expenditure

The increase in healthcare expenditure in the United States is significantly impacting the hematuria treatment market. With healthcare spending projected to reach approximately $6 trillion by 2027, there is a growing investment in advanced medical technologies and treatment options. This financial commitment allows for the development and implementation of innovative therapies for hematuria, enhancing patient outcomes. Additionally, as insurance coverage expands, more patients are likely to seek treatment for urinary disorders, further driving market growth. The correlation between increased healthcare spending and the demand for effective hematuria treatments suggests a robust future for the market, as both patients and providers prioritize quality care.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is influencing the hematuria treatment market. As healthcare systems emphasize the importance of early detection and prevention, there is a growing focus on screening for urinary disorders. This proactive approach not only aids in the early identification of hematuria but also encourages patients to engage in regular health check-ups. The integration of preventive measures into healthcare practices is likely to lead to an increase in the number of patients diagnosed with hematuria, thereby driving demand for treatment options. Furthermore, as patients become more health-conscious, the market may see a rise in the adoption of preventive strategies, which could ultimately enhance the overall effectiveness of hematuria treatments.

Increasing Prevalence of Urinary Disorders

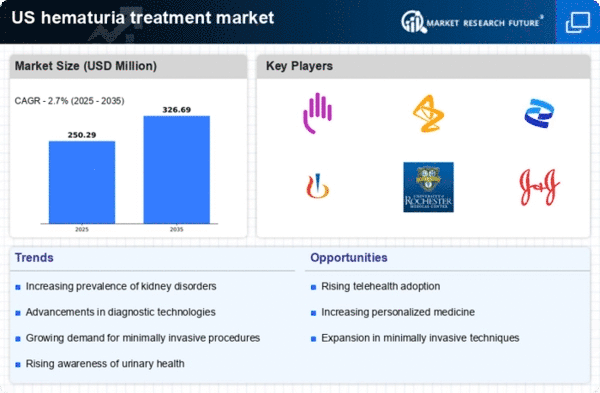

The rising incidence of urinary disorders, including hematuria, is a primary driver for the hematuria treatment market. According to recent data, urinary tract infections and kidney stones are becoming more common, leading to a higher demand for effective treatment options. This trend is particularly evident in the aging population, where the prevalence of such conditions is significantly higher. As healthcare providers increasingly recognize the need for specialized treatments, the market is expected to expand. The growing awareness among patients regarding urinary health also contributes to this trend, as individuals seek medical advice and treatment options. Consequently, Substantial growth is expected, driven by the increasing number of patients requiring intervention for urinary disorders..

Growing Awareness and Education on Urinary Health

The heightened awareness and education surrounding urinary health are pivotal in driving the hematuria treatment market. Campaigns aimed at educating the public about the symptoms and risks associated with hematuria are encouraging individuals to seek medical attention sooner. This proactive approach is leading to earlier diagnoses and, consequently, a higher demand for treatment options. Healthcare providers are also increasingly focusing on patient education, which empowers individuals to take charge of their health. As awareness continues to grow, it is likely that more patients will present with hematuria, thereby expanding the market for treatment options. This trend underscores the importance of education in improving health outcomes and driving market growth.

Technological Innovations in Treatment Modalities

Technological advancements in treatment modalities are reshaping the hematuria treatment market. Innovations such as laser therapies and advanced imaging techniques are enhancing the efficacy of treatments while minimizing patient discomfort. For instance, the introduction of minimally invasive procedures has led to quicker recovery times and reduced hospital stays, which are appealing to both patients and healthcare providers. Furthermore, the integration of artificial intelligence in diagnostic tools is improving the accuracy of hematuria assessments, allowing for more tailored treatment plans. As these technologies continue to evolve, they are expected to drive market growth by providing more effective and patient-friendly treatment options, thereby attracting a larger patient base.