Growing Military Helicopter Fleet

The Global US Helicopter MRO Market Industry is bolstered by the expansion of military helicopter fleets, which require extensive maintenance and repair services. As defense budgets increase, governments are investing in modernizing their military capabilities, leading to an uptick in helicopter acquisitions. This trend necessitates a robust MRO infrastructure to support the operational readiness of military helicopters. With the growing emphasis on maintaining fleet efficiency and effectiveness, the demand for specialized MRO services tailored to military specifications is likely to rise. This segment of the market is expected to contribute significantly to the overall growth, particularly as military operations evolve.

Increasing Demand for Helicopter Services

The Global US Helicopter MRO Market Industry experiences a notable surge in demand for helicopter services across various sectors, including emergency medical services, law enforcement, and tourism. This heightened demand is driven by the need for rapid response capabilities and efficient transportation solutions. As a result, the market is projected to reach 12.5 USD Billion in 2024, reflecting a robust growth trajectory. The expansion of helicopter services necessitates regular maintenance and repair, thereby bolstering the MRO segment. This trend indicates a growing reliance on helicopters for critical operations, which in turn fuels the need for comprehensive MRO services.

Regulatory Compliance and Safety Standards

The Global US Helicopter MRO Market Industry is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate regular inspections, maintenance, and upgrades to ensure operational safety and reliability. As helicopter operations expand, the emphasis on adhering to these standards intensifies, driving demand for MRO services. Companies must invest in maintaining compliance to avoid penalties and ensure the safety of their operations. This regulatory landscape not only shapes the operational strategies of helicopter operators but also creates a steady demand for MRO services, thereby supporting the overall growth of the market.

Market Growth Projections and Economic Factors

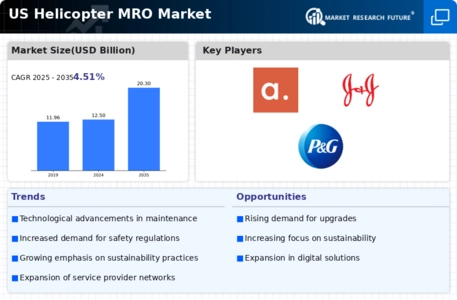

Charts illustrating the projected growth trajectory of the Global US Helicopter MRO Market Industry, including revenue forecasts for 2024 and 2035, as well as the expected CAGR from 2025 to 2035.

Technological Advancements in Helicopter Maintenance

Technological innovations play a pivotal role in shaping the Global US Helicopter MRO Market Industry. The integration of advanced diagnostic tools, predictive maintenance technologies, and digital platforms enhances the efficiency and effectiveness of maintenance operations. These advancements not only reduce downtime but also improve safety standards, which is crucial in the aviation sector. As helicopters become more sophisticated, the demand for specialized MRO services that can handle these technologies increases. This trend is expected to contribute to the market's growth, with projections indicating a compound annual growth rate (CAGR) of 4.51% from 2025 to 2035, highlighting the importance of staying abreast of technological developments.