Rising Electricity Prices

The grid connected-pv-systems market is also driven by rising electricity prices across the US. As utility rates continue to climb, consumers are increasingly seeking alternative energy solutions. As utility rates continue to climb, consumers are increasingly seeking alternative energy solutions to mitigate their energy costs. In 2025, the average residential electricity price reached approximately $0.14 per kWh, prompting many homeowners to consider solar energy as a cost-effective option. By investing in grid connected-pv-systems, consumers can generate their own electricity, potentially reducing their reliance on the grid and lowering their overall energy expenses. This trend suggests a growing market for solar energy solutions, as more individuals and businesses look to offset rising utility costs through renewable energy.

Declining Costs of Solar Technology

The grid connected-pv-systems market is significantly influenced by the declining costs associated with solar technology. Over the past decade, the cost of solar photovoltaic (PV) systems has decreased by nearly 70%. Over the past decade, the cost of solar photovoltaic (PV) systems has decreased by nearly 70%, making solar energy more accessible to a broader range of consumers. This reduction in costs is attributed to advancements in manufacturing processes, economies of scale, and increased competition among solar providers. As of 2025, the average cost of solar installations in the US is around $2.50 per watt, which is expected to continue decreasing. This trend not only enhances the affordability of grid connected-pv-systems but also encourages more homeowners and businesses to invest in solar energy, thereby expanding the market.

Government Incentives and Tax Credits

The grid connected-pv-systems market benefits from various government incentives and tax credits. These are aimed at promoting renewable energy adoption. Federal tax credits, such as the Investment Tax Credit (ITC), allow homeowners and businesses to deduct a significant percentage of the cost of solar installations from their federal taxes. As of 2025, the ITC stands at 26%, providing a substantial financial incentive for consumers to invest in grid connected-pv-systems. Additionally, many states offer their own incentives, including rebates and performance-based incentives, which further enhance the economic viability of solar energy projects. These financial mechanisms are likely to stimulate market growth by making solar installations more attractive to potential investors.

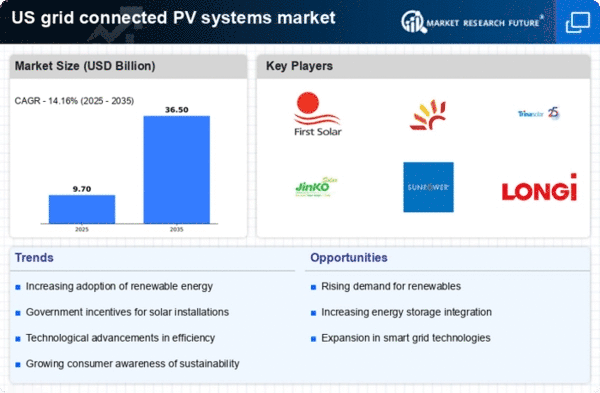

Increasing Demand for Renewable Energy

The grid connected-pv-systems market is experiencing a surge in demand. This surge is driven by a growing awareness of climate change and the need for sustainable energy solutions. As consumers and businesses alike seek to reduce their carbon footprints, the adoption of solar energy technologies has become more prevalent. In 2025, renewable energy sources accounted for approximately 20% of total electricity generation in the US, with solar energy contributing a significant portion. This trend indicates a robust market potential for grid connected-pv-systems, as they provide a viable solution for harnessing solar energy efficiently. Furthermore, the increasing number of states implementing renewable portfolio standards is likely to further bolster the market, as utilities are mandated to source a certain percentage of their energy from renewable sources.

Technological Innovations in Solar Energy

The grid connected-pv-systems market is poised for growth due to ongoing technological innovations in solar energy. Advancements in solar panel efficiency, energy management systems, and smart grid technologies are enhancing the performance and reliability of solar installations. Advancements in solar panel efficiency, energy management systems, and smart grid technologies are enhancing the performance and reliability of solar installations. For instance, the development of bifacial solar panels, which can capture sunlight from both sides, has shown to increase energy output by up to 30%. Additionally, the integration of smart inverters and energy storage solutions is enabling consumers to optimize their energy usage and maximize savings. These innovations not only improve the overall efficiency of grid connected-pv-systems but also make them more appealing to a wider audience, thereby driving market expansion.