Market Growth Projections

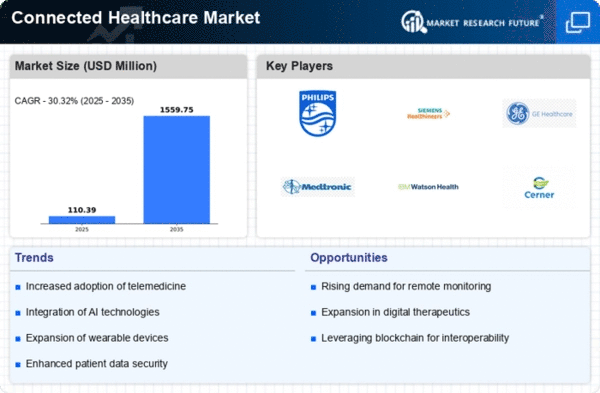

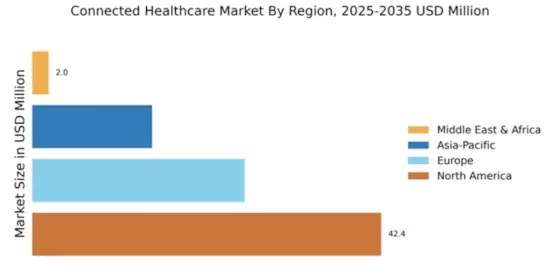

The Global Connected Healthcare Market Industry is poised for substantial growth, with projections indicating a market value of 1.56 USD Billion by 2035. The anticipated compound annual growth rate (CAGR) of 31.03% from 2025 to 2035 highlights the dynamic nature of this sector. The increasing integration of technology in healthcare, coupled with rising consumer expectations for personalized care, drives this growth. Additionally, the ongoing advancements in telehealth, wearable devices, and data analytics contribute to the expanding market landscape. These projections suggest a transformative period for connected healthcare, with the potential to revolutionize patient care and healthcare delivery.

Government Initiatives and Funding

Government initiatives and funding are crucial drivers of the Global Connected Healthcare Market Industry. Many countries are investing in digital health infrastructure to improve healthcare access and quality. For instance, various governments are implementing policies that promote telehealth and connected devices, thereby incentivizing healthcare providers to adopt these technologies. Such initiatives not only enhance patient care but also stimulate economic growth within the healthcare sector. The financial support from governments is expected to catalyze innovation and expansion in connected healthcare solutions, ultimately leading to a more integrated healthcare ecosystem.

Advancements in Wearable Technology

Wearable technology plays a pivotal role in the Global Connected Healthcare Market Industry, as devices such as smartwatches and fitness trackers enable continuous health monitoring. These devices collect real-time data on vital signs, physical activity, and other health metrics, empowering users to take charge of their health. The integration of wearables with healthcare systems enhances patient engagement and facilitates timely interventions. As the technology evolves, the market is likely to witness increased adoption, contributing to the overall growth trajectory. The convergence of wearables with telehealth solutions further amplifies their impact on healthcare delivery.

Rising Demand for Telehealth Services

The Global Connected Healthcare Market Industry experiences a notable increase in demand for telehealth services, driven by the need for accessible healthcare solutions. As patients seek alternatives to traditional in-person visits, telehealth platforms facilitate remote consultations, monitoring, and follow-ups. In 2024, the market is valued at 0.08 USD Billion, reflecting a growing acceptance of virtual healthcare. This trend is expected to accelerate, with projections indicating a market value of 1.56 USD Billion by 2035. The compound annual growth rate (CAGR) of 31.03% from 2025 to 2035 underscores the potential for telehealth to reshape healthcare delivery globally.

Enhanced Data Security and Privacy Measures

Data security and privacy are paramount in the Global Connected Healthcare Market Industry, particularly as the volume of health data generated by connected devices increases. The implementation of robust security protocols and compliance with regulations, such as HIPAA, are essential to protect patient information. As healthcare organizations prioritize data security, the trust of patients in connected healthcare solutions is likely to improve. This trust is crucial for the widespread adoption of connected technologies. Enhanced security measures not only safeguard sensitive information but also foster innovation, as developers create solutions that meet stringent security requirements.

Growing Focus on Chronic Disease Management

The Global Connected Healthcare Market Industry is significantly influenced by the increasing prevalence of chronic diseases, necessitating effective management strategies. Connected healthcare solutions enable healthcare providers to monitor patients with chronic conditions remotely, ensuring timely interventions and reducing hospital readmissions. The integration of data analytics and artificial intelligence in these solutions enhances decision-making and personalized care. As the population ages and the burden of chronic diseases rises, the demand for connected healthcare solutions is likely to grow. This trend aligns with the projected market growth, indicating a robust future for chronic disease management through connected technologies.