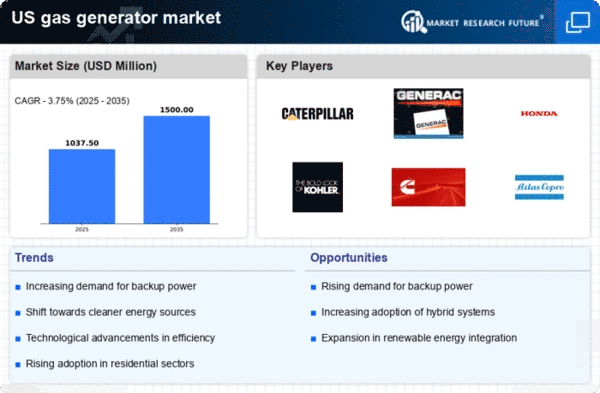

Rising Energy Costs

The gas generator market is experiencing a notable surge due to the rising costs of energy in the US. As utility rates continue to climb, consumers and businesses are increasingly seeking alternative energy solutions to mitigate expenses. Gas generators provide a cost-effective means of generating power, particularly during peak demand periods when electricity prices soar. This trend is further supported by the fact that natural gas prices have remained relatively stable compared to other energy sources. Consequently, the gas generator market is likely to see a significant uptick in demand as users look for reliable and economical power solutions.

Growing Industrial Applications

The gas generator market is expanding due to the increasing adoption of gas generators in various industrial applications. Industries such as construction, manufacturing, and telecommunications are increasingly relying on gas generators for their power needs. The versatility and reliability of gas generators make them suitable for a wide range of applications, from providing backup power to supporting remote operations. As industries continue to grow and evolve, the demand for efficient and dependable power solutions is likely to drive the gas generator market further, creating new opportunities for manufacturers and suppliers.

Regulatory Support for Clean Energy

The gas generator market is benefiting from a favorable regulatory environment that promotes cleaner energy solutions. Various state and federal initiatives are encouraging the adoption of natural gas as a transitional fuel towards more sustainable energy sources. Incentives such as tax credits and grants for cleaner technologies are driving investments in gas generators. The US government has set ambitious targets for reducing greenhouse gas emissions, which may further bolster the gas generator market as businesses and consumers seek compliant energy solutions. This regulatory support is likely to enhance the market's growth trajectory in the coming years.

Increased Frequency of Power Outages

The gas generator market is witnessing growth due to the increasing frequency of power outages across the US. Factors such as aging infrastructure, extreme weather events, and rising energy demands contribute to this trend. As a result, both residential and commercial sectors are investing in gas generators to ensure uninterrupted power supply. According to recent data, the number of outages has risen by approximately 30% over the past decade, prompting consumers to prioritize backup power solutions. This heightened awareness of the need for reliable energy sources is likely to drive the gas generator market forward.

Technological Innovations in Generator Design

The gas generator market is being propelled by ongoing technological innovations. These innovations enhance the efficiency and performance of gas generators. Advances in engine design, fuel efficiency, and emissions control technologies are making gas generators more appealing to consumers. These innovations not only improve the operational capabilities of generators but also align with the growing demand for environmentally friendly energy solutions. As manufacturers continue to invest in research and development, the gas generator market is expected to benefit from improved product offerings that meet the evolving needs of users.