Expansion of Consumer Electronics

The frequency synthesizer market is significantly influenced by the expansion of the consumer electronics sector. With the increasing adoption of smart devices, including smartphones, tablets, and wearables, the demand for high-performance frequency synthesizers is on the rise. In 2025, the consumer electronics market in the US is expected to reach approximately $400 billion, with a substantial portion allocated to advanced electronic components. This trend indicates a growing reliance on frequency synthesizers to ensure optimal performance and functionality in these devices. As manufacturers strive to meet consumer expectations for enhanced features and connectivity, the frequency synthesizer market is likely to see robust growth, driven by the need for innovative solutions that support the latest technological advancements.

Emergence of Wireless Technologies

The frequency synthesizer market is poised for growth due to the emergence of wireless technologies. As industries transition towards wireless communication solutions, the need for reliable frequency generation becomes increasingly vital. The wireless technology market in the US is projected to exceed $200 billion by 2025, driven by the demand for seamless connectivity and data transfer. This trend indicates that the frequency synthesizer market will likely benefit from the growing adoption of wireless systems across various sectors, including telecommunications, healthcare, and industrial automation. As companies seek to enhance their wireless capabilities, the demand for advanced frequency synthesizers is expected to rise, further propelling market growth.

Advancements in Automotive Technologies

The frequency synthesizer market is experiencing a transformation due to advancements in automotive technologies. The automotive industry is increasingly integrating sophisticated electronic systems, including advanced driver-assistance systems (ADAS) and infotainment solutions. These systems require precise frequency generation for optimal performance, thereby driving demand for frequency synthesizers. The US automotive market is projected to reach $1 trillion by 2026, with a significant portion dedicated to electronic components. This growth suggests that the frequency synthesizer market will play a crucial role in supporting the automotive sector's evolution towards more connected and automated vehicles, as manufacturers seek to enhance safety and user experience through advanced electronic solutions.

Growth in Aerospace and Defense Applications

The frequency synthesizer market is significantly impacted by the growth in aerospace and defense applications. As the US government continues to invest in defense modernization and aerospace innovation, the demand for high-precision frequency synthesizers is expected to rise. The aerospace sector, valued at approximately $250 billion in 2025, relies heavily on frequency synthesizers for radar, communication, and navigation systems. This reliance indicates a robust opportunity for the frequency synthesizer market to expand its footprint within these critical sectors. Furthermore, the increasing focus on national security and technological superiority suggests that investments in frequency synthesizer technologies will continue to grow, thereby enhancing the market's prospects.

Rising Demand for Communication Technologies

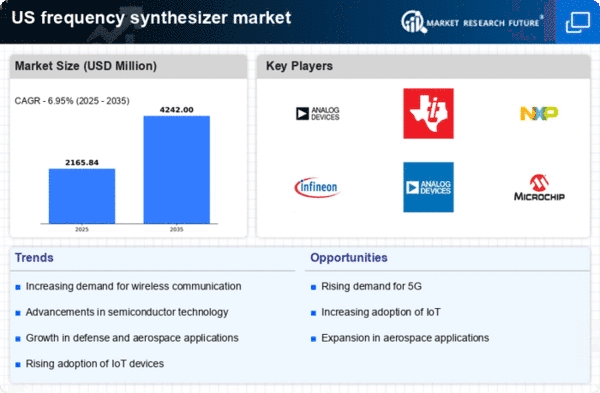

The frequency synthesizer market experiences a notable surge in demand driven by the increasing need for advanced communication technologies. As industries such as telecommunications and aerospace expand, the requirement for precise frequency generation becomes paramount. The market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, reflecting the critical role of frequency synthesizers in enabling high-speed data transmission and reliable communication systems. This growth is further fueled by the proliferation of 5G networks, which necessitate sophisticated frequency management solutions. Consequently, the frequency synthesizer market is poised to benefit significantly from these advancements, as companies invest in innovative technologies to enhance their communication capabilities.