Rising Security Concerns

The fingerprint biometrics market is experiencing growth driven by escalating security concerns across various sectors. Organizations are increasingly prioritizing the protection of sensitive data and assets, leading to a surge in the adoption of biometric solutions. In the financial sector, for instance, the implementation of fingerprint authentication has been shown to reduce fraud incidents by up to 30%. This heightened focus on security is not limited to financial institutions; healthcare, government, and retail sectors are also investing in fingerprint biometrics to enhance security protocols. As cyber threats evolve, the demand for reliable and secure authentication methods is likely to propel the fingerprint biometrics market further.

Integration with IoT Devices

The integration of fingerprint biometrics with Internet of Things (IoT) devices is emerging as a significant driver for the fingerprint biometrics market. As smart devices proliferate, the need for secure access control becomes paramount. For example, smart home systems that utilize fingerprint recognition can provide users with seamless and secure access to their homes. The market for IoT devices is projected to reach $1 trillion by 2025, and incorporating biometric authentication can enhance user trust and security. This trend indicates a growing synergy between fingerprint biometrics and IoT, potentially expanding the market's reach and applications.

Consumer Demand for Convenience

The fingerprint biometrics market is also being driven by consumer demand for convenience and user-friendly authentication methods. As individuals seek faster and more efficient ways to access devices and services, fingerprint recognition offers a compelling solution. The proliferation of smartphones equipped with fingerprint sensors has set a precedent, with over 70% of new devices featuring this technology. This trend reflects a broader consumer preference for biometric solutions that streamline user experiences while maintaining security. As more consumers embrace fingerprint biometrics, the market is expected to expand significantly.

Government Initiatives and Funding

Government initiatives aimed at enhancing national security and public safety are playing a crucial role in the growth of the fingerprint biometrics market. Various federal and state programs are allocating funds to develop and implement biometric identification systems. For instance, the Department of Homeland Security has invested in biometric technologies to improve border security and immigration processes. Such initiatives not only bolster the market but also encourage private sector investment in biometric solutions. The financial backing from government entities is likely to stimulate innovation and adoption within the fingerprint biometrics market.

Technological Advancements in Biometric Systems

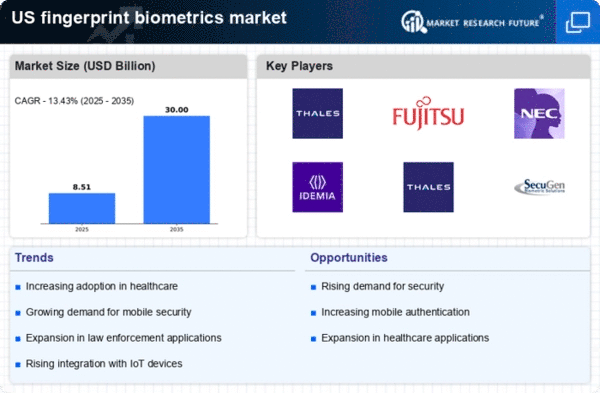

Technological advancements in biometric systems are significantly influencing the fingerprint biometrics market. Innovations in sensor technology, algorithms, and data processing capabilities are enhancing the accuracy and reliability of fingerprint recognition systems. For instance, the introduction of capacitive sensors has improved the ability to capture high-quality fingerprint images, leading to better authentication outcomes. The market is projected to grow at a CAGR of 15% over the next five years, driven by these advancements. As technology continues to evolve, the fingerprint biometrics market is likely to benefit from increased efficiency and effectiveness in biometric solutions.