Increasing Cybersecurity Concerns

The fingerprint biometrics market in Japan is significantly influenced by escalating cybersecurity concerns. With the rise in cyber threats and data breaches, organizations are compelled to adopt more secure authentication methods. Fingerprint biometrics offers a unique advantage, as it is inherently tied to the individual, making it difficult for unauthorized access. In 2025, the cybersecurity market in Japan is projected to reach $10 billion, with a substantial portion allocated to biometric solutions. This trend indicates a growing recognition of the importance of biometric authentication in safeguarding sensitive information. As businesses and government entities prioritize cybersecurity, the adoption of fingerprint biometrics is likely to increase, reinforcing its position as a vital component in comprehensive security strategies.

Government Regulations and Compliance

Government regulations and compliance requirements significantly impact the fingerprint biometrics market in Japan. As data protection laws become more stringent, organizations are mandated to implement secure authentication methods to protect personal information. The Personal Information Protection Act (PIPA) in Japan emphasizes the need for robust security measures, including biometric authentication. This regulatory landscape encourages businesses to invest in fingerprint biometrics systems to ensure compliance and mitigate legal risks. In 2025, the market is expected to grow by approximately 12% as organizations seek to align with these regulations. The emphasis on compliance not only drives demand for fingerprint biometrics but also fosters innovation in the development of secure and user-friendly biometric solutions.

Growing Adoption in Healthcare Sector

The fingerprint biometrics market in Japan is witnessing a growing adoption within the healthcare sector. As healthcare providers increasingly prioritize patient data security and streamlined access to medical records, fingerprint biometrics offers a reliable solution for identity verification. Hospitals and clinics are implementing biometric systems to ensure that only authorized personnel can access sensitive patient information. In 2025, the healthcare biometrics market is projected to reach $500 million, with fingerprint recognition being a key contributor to this growth. The ability to enhance patient safety and improve operational efficiency positions fingerprint biometrics as an essential tool in modern healthcare. As the sector continues to evolve, the integration of biometric solutions is likely to expand, further solidifying their role in healthcare security.

Rising Demand for Secure Transactions

The fingerprint biometrics market in Japan experiences a notable surge in demand for secure transaction methods. As digital payment systems proliferate, consumers and businesses alike seek robust security measures to protect sensitive financial information. The integration of fingerprint biometrics into payment systems enhances security, reducing fraud risks. In 2025, the market for biometric payment solutions is projected to reach approximately $1.5 billion, indicating a growth rate of around 20% annually. This trend reflects a broader shift towards contactless and secure payment methods, positioning fingerprint biometrics as a critical component in the evolving landscape of financial transactions. The increasing reliance on mobile wallets and e-commerce platforms further propels the adoption of fingerprint biometrics, as users prioritize security and convenience in their financial interactions.

Technological Advancements in Biometric Systems

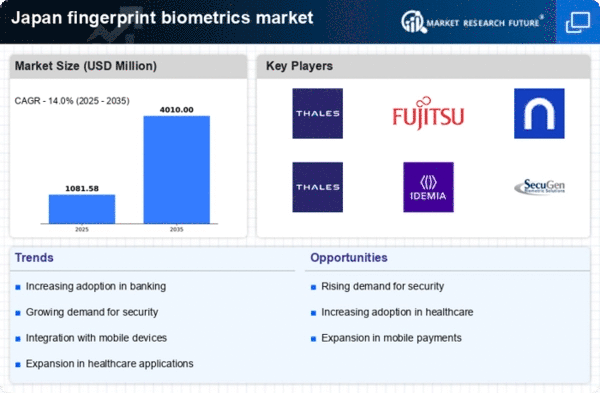

Technological advancements play a pivotal role in shaping the fingerprint biometrics market in Japan. Innovations in sensor technology, algorithms, and data processing capabilities enhance the accuracy and speed of fingerprint recognition systems. The introduction of advanced optical and capacitive sensors has improved the reliability of biometric authentication, making it more appealing for various applications, including access control and identity verification. In 2025, the market is expected to witness a compound annual growth rate (CAGR) of approximately 15%, driven by these technological improvements. Furthermore, the integration of artificial intelligence and machine learning into biometric systems enhances their adaptability and performance, allowing for real-time processing and increased security. As organizations seek to implement cutting-edge security solutions, the demand for advanced fingerprint biometrics systems continues to rise.