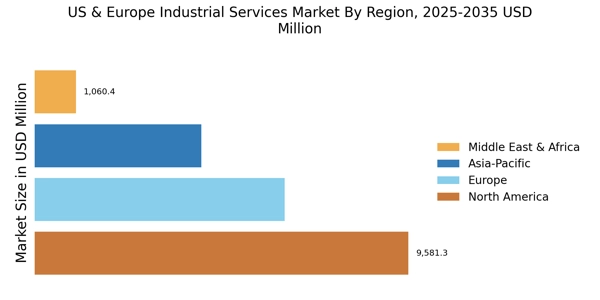

North America : Innovation and Technology Leader

North America is the largest market for industrial services, holding approximately 45% of the global share. Key growth drivers include advancements in automation, IoT integration, and a strong focus on sustainability. Regulatory support from government initiatives aimed at enhancing manufacturing efficiency and reducing emissions further catalyzes market growth. The region's demand for smart manufacturing solutions is on the rise, driven by the need for operational efficiency and cost reduction.

The United States leads the North American market, with significant contributions from Canada and Mexico. Major players like General Electric, Honeywell, and Rockwell Automation dominate the landscape, leveraging their technological expertise to offer innovative solutions. The competitive environment is characterized by strategic partnerships and mergers, enhancing service offerings and market reach. The presence of robust infrastructure and skilled workforce further strengthens the region's position in the industrial services sector.

Europe : Sustainability and Innovation Focus

Europe is the second-largest market for industrial services, accounting for around 30% of the global share. The region is witnessing a surge in demand for sustainable industrial practices, driven by stringent regulations and a commitment to reducing carbon footprints. The European Green Deal and various national initiatives are pivotal in shaping market dynamics, promoting investments in clean technologies and energy-efficient solutions. This regulatory landscape is fostering innovation and enhancing competitiveness across the sector.

Germany, France, and the UK are the leading countries in this market, with Germany holding a significant share due to its strong manufacturing base. Key players like Siemens, Schneider Electric, and ABB are at the forefront, driving technological advancements and service diversification. The competitive landscape is marked by a focus on digital transformation and smart manufacturing, with companies investing heavily in R&D to stay ahead. The presence of a skilled workforce and advanced infrastructure further supports the region's industrial services growth.

Asia-Pacific : Rapid Growth and Expansion

Asia-Pacific is an emerging powerhouse in the industrial services market, holding approximately 20% of the global share. The region is experiencing rapid industrialization, urbanization, and a growing demand for automation solutions. Countries like China and India are leading this growth, driven by government initiatives aimed at enhancing manufacturing capabilities and infrastructure development. The increasing focus on smart factories and Industry 4.0 technologies is further propelling market expansion, supported by favorable regulatory frameworks.

China is the largest market in the region, followed by India and Japan. The competitive landscape is characterized by a mix of local and international players, with companies like KUKA and Emerson Electric making significant inroads. The presence of a large consumer base and investments in technology are driving innovation and service diversification. As the region continues to evolve, the demand for advanced industrial services is expected to rise, creating new opportunities for growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa represent a resource-rich frontier for industrial services, holding about 5% of the global market share. The region is witnessing increasing investments in infrastructure and industrial development, driven by government initiatives aimed at diversifying economies away from oil dependency. The push for modernization and technological adoption in sectors like manufacturing and energy is creating new demand for industrial services, supported by favorable regulatory environments in several countries.

Countries like South Africa, UAE, and Saudi Arabia are leading the charge, with significant investments in industrial projects. The competitive landscape is evolving, with both local and international players vying for market share. Companies are focusing on enhancing service offerings and leveraging technology to meet the growing demand. As the region continues to develop, the industrial services market is poised for substantial growth, presenting opportunities for both established and new entrants.