Growing Demand for Network Agility

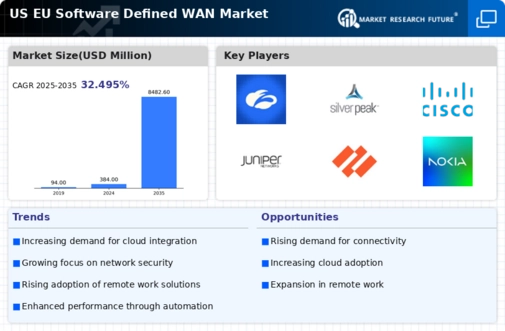

The US Software Defined Wide Area Network Market is experiencing a notable surge in demand for network agility. Organizations are increasingly seeking solutions that allow for rapid deployment and reconfiguration of network resources. This demand is driven by the need for businesses to adapt quickly to changing market conditions and customer requirements. According to recent data, the market for SD-WAN solutions in the US is projected to grow at a compound annual growth rate (CAGR) of approximately 30% over the next five years. This growth reflects a broader trend towards digital transformation, where companies prioritize flexibility and responsiveness in their network infrastructure. As enterprises continue to embrace cloud-based applications and services, the ability to dynamically manage network traffic becomes essential, further propelling the adoption of SD-WAN technologies.

Integration with Emerging Technologies

The integration of emerging technologies is a key driver in the US Software Defined Wide Area Network Market. As organizations explore the potential of Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), the need for advanced networking solutions becomes increasingly apparent. SD-WAN technologies are well-positioned to support these innovations by providing the necessary bandwidth and flexibility to accommodate the growing volume of data generated by connected devices. Moreover, the ability to leverage AI and ML for network optimization enhances the overall performance and reliability of SD-WAN solutions. This synergy between SD-WAN and emerging technologies is expected to foster innovation and drive market growth, as businesses seek to harness the power of data-driven insights and automation in their operations.

Regulatory Compliance and Data Privacy

In the US Software Defined Wide Area Network Market, regulatory compliance and data privacy concerns are increasingly influencing the adoption of SD-WAN solutions. Organizations are required to adhere to stringent regulations regarding data protection, such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). SD-WAN technologies offer enhanced security features, including encryption and secure access controls, which assist businesses in meeting these compliance requirements. As data breaches and cyber threats continue to escalate, the emphasis on safeguarding sensitive information is paramount. Consequently, companies are turning to SD-WAN solutions that not only provide connectivity but also bolster their security posture, thereby ensuring compliance with regulatory mandates. This trend is expected to drive growth in the SD-WAN market as organizations prioritize secure and compliant network infrastructures.

Cost Efficiency and Operational Savings

Cost efficiency remains a pivotal driver in the US Software Defined Wide Area Network Market. Organizations are increasingly recognizing the financial benefits associated with SD-WAN solutions, which often lead to reduced operational costs. By leveraging broadband internet connections and optimizing network traffic, businesses can significantly lower their reliance on expensive MPLS circuits. Reports indicate that companies implementing SD-WAN can achieve cost savings of up to 50% compared to traditional WAN solutions. This financial incentive is particularly appealing to small and medium-sized enterprises (SMEs) that are looking to enhance their network capabilities without incurring substantial expenses. As the competitive landscape intensifies, the ability to maintain cost-effective operations while ensuring robust connectivity is likely to drive further adoption of SD-WAN technologies across various sectors.

Increased Focus on Remote Work Solutions

The shift towards remote work has significantly impacted the US Software Defined Wide Area Network Market. As organizations adapt to a hybrid work model, the demand for reliable and secure network solutions has intensified. SD-WAN technologies facilitate seamless connectivity for remote employees, enabling them to access corporate resources securely from various locations. This trend is underscored by the fact that a substantial percentage of the US workforce is now working remotely, necessitating robust network solutions that can support distributed teams. Furthermore, SD-WAN's ability to prioritize application performance and ensure consistent user experiences is particularly appealing in this context. As businesses continue to invest in remote work infrastructure, the adoption of SD-WAN solutions is likely to accelerate, reflecting the evolving nature of work in the digital age.