Growing Demand for Network Agility

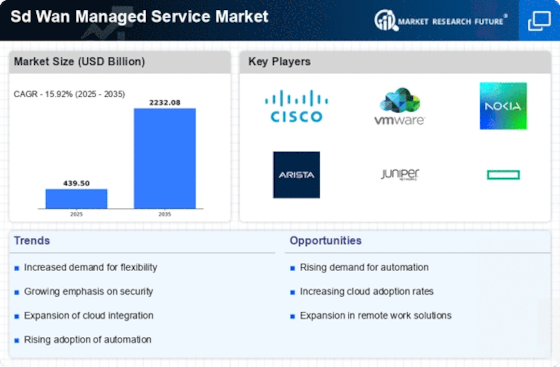

The Sd Wan Managed Service Market Industry is experiencing a notable surge in demand for network agility. Organizations are increasingly seeking solutions that allow for rapid deployment and flexibility in their network infrastructure. This demand is driven by the need for businesses to adapt quickly to changing market conditions and customer requirements. According to recent data, the market for Sd Wan managed services is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth indicates a strong preference for services that enhance operational efficiency and reduce latency, thereby enabling organizations to respond swiftly to market dynamics.

Integration with Emerging Technologies

The integration of emerging technologies is a significant driver in the Sd Wan Managed Service Market Industry. As businesses increasingly adopt technologies such as Internet of Things (IoT) and artificial intelligence (AI), the need for robust and scalable networking solutions becomes paramount. Sd Wan managed services provide the necessary infrastructure to support these technologies, enabling seamless connectivity and data transfer. Market analysis suggests that the adoption of IoT devices is expected to reach 75 billion by 2025, further emphasizing the need for efficient networking solutions. This integration capability is likely to enhance the appeal of Sd Wan managed services, positioning them as essential components in modern IT strategies.

Cost Efficiency and Operational Savings

Cost efficiency remains a pivotal driver in the Sd Wan Managed Service Market Industry. Enterprises are increasingly recognizing the financial benefits associated with adopting managed services. By leveraging Sd Wan solutions, organizations can significantly reduce their operational costs related to traditional WAN architectures. Studies suggest that businesses can save up to 30% on their networking expenses by transitioning to Sd Wan managed services. This cost-effectiveness is particularly appealing to small and medium-sized enterprises, which often operate with limited budgets. As a result, the trend towards cost savings is likely to propel further adoption of Sd Wan managed services in various sectors.

Regulatory Compliance and Data Security

Regulatory compliance and data security are becoming increasingly critical in the Sd Wan Managed Service Market Industry. As organizations face stringent regulations regarding data protection, the demand for secure networking solutions is on the rise. Sd Wan managed services offer advanced security features, including encryption and secure access controls, which help organizations meet compliance requirements. Recent statistics indicate that nearly 70% of enterprises consider security a top priority when selecting networking solutions. This heightened focus on compliance and security is expected to drive the growth of Sd Wan managed services, as businesses seek to mitigate risks associated with data breaches and regulatory penalties.

Enhanced User Experience and Performance

The Sd Wan Managed Service Market Industry is also driven by the need for enhanced user experience and performance. Organizations are increasingly focused on delivering superior application performance to their end-users. Sd Wan solutions facilitate optimized traffic management, ensuring that critical applications receive the necessary bandwidth and low latency. This focus on performance is underscored by data indicating that businesses utilizing Sd Wan managed services report a 50% improvement in application performance. Consequently, the emphasis on user experience is likely to continue influencing the adoption of Sd Wan managed services across diverse industries.