Integration of Advanced Analytics

The US Equipment Monitoring Market is increasingly influenced by the integration of advanced analytics. Companies are leveraging data analytics to enhance operational efficiency and predictive maintenance. By analyzing equipment performance data, organizations can identify potential failures before they occur, thereby reducing downtime and maintenance costs. According to recent estimates, the market for predictive analytics in equipment monitoring is projected to grow significantly, driven by the need for real-time insights. This trend suggests that businesses are prioritizing data-driven decision-making, which is likely to enhance productivity and extend equipment lifespan. As a result, the integration of advanced analytics is becoming a critical driver in the US Equipment Monitoring Market.

Increased Focus on Asset Management

The US Equipment Monitoring Market is experiencing an increased focus on asset management practices. Organizations are recognizing the importance of effectively managing their assets to optimize performance and reduce costs. This trend is reflected in the growing adoption of equipment monitoring systems that provide insights into asset utilization and condition. Market Research Future indicates that companies implementing robust asset management strategies can achieve up to a 20% reduction in operational costs. Furthermore, the integration of equipment monitoring with asset management systems allows for better resource allocation and planning. As such, the emphasis on asset management is a key driver in the US Equipment Monitoring Market.

Growing Emphasis on Regulatory Compliance

The US Equipment Monitoring Market is increasingly shaped by a growing emphasis on regulatory compliance. Organizations are required to adhere to stringent regulations regarding equipment safety and performance, particularly in sectors such as healthcare and manufacturing. Compliance with these regulations necessitates the implementation of effective monitoring systems to ensure that equipment operates within specified parameters. Market analysis indicates that companies investing in compliance-driven equipment monitoring solutions can mitigate risks and avoid costly penalties. This trend underscores the importance of regulatory compliance as a key driver in the US Equipment Monitoring Market, as businesses strive to meet legal requirements while enhancing operational efficiency.

Rising Demand for Remote Monitoring Solutions

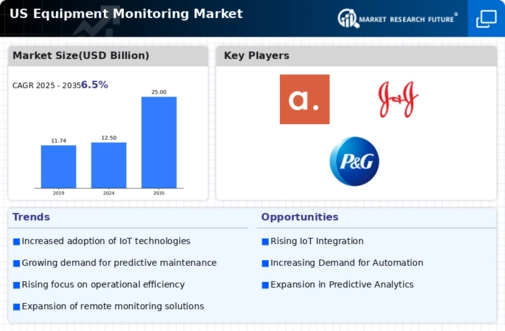

The US Equipment Monitoring Market is witnessing a rising demand for remote monitoring solutions. This trend is largely attributed to the need for real-time visibility into equipment performance, especially in industries such as manufacturing and construction. Remote monitoring allows organizations to track equipment health and performance from any location, facilitating timely interventions. Market data indicates that the adoption of remote monitoring technologies is expected to increase, with a projected growth rate of over 15% annually. This shift not only enhances operational efficiency but also supports workforce safety by minimizing the need for on-site inspections. Consequently, the demand for remote monitoring solutions is a significant driver in the US Equipment Monitoring Market.

Technological Advancements in Sensor Technologies

The US Equipment Monitoring Market is significantly driven by technological advancements in sensor technologies. Innovations in sensor design and functionality are enabling more accurate and reliable monitoring of equipment conditions. These advancements facilitate the collection of real-time data, which is essential for effective decision-making. Market data suggests that the sensor technology segment is expected to grow at a compound annual growth rate of over 10% in the coming years. This growth is likely to be fueled by the increasing demand for high-precision monitoring solutions across various sectors, including energy and manufacturing. Therefore, advancements in sensor technologies are a pivotal driver in the US Equipment Monitoring Market.