Corporate Sustainability Commitments

An increasing number of corporations are making sustainability commitments, which is driving the energy as-a-service market. Many companies are setting ambitious targets to achieve net-zero emissions by 2030 or 2040, prompting them to seek innovative energy solutions. The energy as-a-service market provides a viable pathway for organizations to meet these commitments by offering flexible and scalable energy solutions. In the US, a survey indicated that over 70% of large corporations are actively pursuing renewable energy sources to fulfill their sustainability goals. This trend not only reflects a shift in corporate responsibility but also indicates a growing recognition of the financial benefits associated with energy efficiency. As more companies embrace sustainability, the energy as-a-service market is likely to see accelerated growth, driven by the demand for solutions that align with corporate values.

Economic Incentives and Policy Support

The energy as-a-service market is significantly influenced by economic incentives and supportive policies at both federal and state levels. Various programs, such as tax credits and rebates for renewable energy installations, encourage businesses to transition to energy as-a-service models. In the US, the federal government has introduced initiatives that aim to reduce the upfront costs associated with renewable energy projects, making them more accessible. Additionally, state-level policies often provide further financial incentives, which can enhance the attractiveness of energy as-a-service offerings. As these economic drivers continue to evolve, they are likely to stimulate market growth, with estimates suggesting that the market could reach a valuation of $50 billion by 2030. This supportive policy landscape is crucial for fostering innovation and investment in the energy as-a-service market.

Rising Demand for Sustainable Solutions

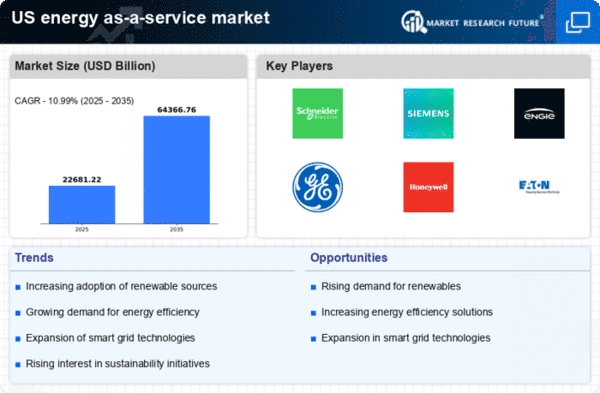

The energy as-a-service market is experiencing a notable surge in demand for sustainable energy solutions. This trend is driven by increasing awareness of climate change and the need for businesses to reduce their carbon footprints. In the US, a significant % of consumers are prioritizing sustainability in their purchasing decisions, which compels companies to adopt energy as-a-service models. Furthermore, regulatory frameworks are evolving to support renewable energy initiatives, creating a conducive environment for the energy as-a-service market. As organizations seek to align with sustainability goals, the market is likely to expand, with projections indicating a potential growth rate of over 15% annually in the coming years. This shift towards sustainability not only enhances corporate responsibility but also positions companies competitively in a market that increasingly values environmental stewardship.

Increased Focus on Resilience and Reliability

The energy as-a-service market is increasingly being shaped by the need for resilience and reliability in energy supply. As extreme weather events and other disruptions become more frequent, businesses are prioritizing energy solutions that ensure continuity of operations. The energy as-a-service market offers integrated solutions that enhance energy resilience, such as backup power systems and microgrids. In the US, studies have shown that companies investing in resilient energy systems can reduce downtime costs by up to 40%. This focus on reliability is prompting organizations to adopt energy as-a-service models that provide not only cost savings but also peace of mind. As the demand for resilient energy solutions grows, the energy as-a-service market is expected to expand, with businesses increasingly recognizing the importance of dependable energy supply in their operational strategies.

Technological Advancements in Energy Management

Technological innovations are playing a pivotal role in the evolution of the energy as-a-service market. Advanced energy management systems, including IoT devices and AI-driven analytics, enable businesses to optimize energy consumption and reduce costs. These technologies facilitate real-time monitoring and predictive maintenance, which can lead to efficiency improvements of up to 30%. As organizations in the US adopt these technologies, they are likely to enhance their operational efficiency and reduce energy waste. The integration of smart grids and energy storage solutions further supports the energy as-a-service market by providing flexible and reliable energy supply options. This technological momentum is expected to drive market growth, as companies increasingly recognize the value of data-driven energy solutions in achieving their operational and sustainability objectives.