Research Methodology on Energy as a Service Market

Market Research Future (MRFR) has adopted a meticulous research methodology to offer credible insights into the renewable energy as a service (EaaS) market. The research provides an understanding of the global EaaS market dynamics, potential opportunities, and technological advancements. MRFR has segmented the global EaaS market to provide a comprehensive outlook of the renewable energy as a service market.

Market Estimation:

To assess the market size of the renewable energy as a service (EaaS) market, we have taken into consideration the previous year’s developments and historical events. Market drivers, opportunities, and trends have been considered to ascertain the market’s current and future performance.

Market Breakdown and Data Triangulation:

The market size of the global EaaS market has been identified by analyzing different electric vehicle market segments. Market size is analyzed in three ways – top-down analysis, bottom-up analysis, and data triangulation. MRFR has collected and validated data from different CROs and primary and secondary data sources, such as credible reports and publications, to determine the market size of the global EaaS market.

Primary Research:

MRFR interviewed industry experts to gain insights into the EaaS market. Our primary research includes interactions with opinion leaders in-person and through email and/ or telephone.

Secondary Research:

MRFR conducted comprehensive secondary research to supplement its primary research. MRFR has taken into account industry publications, such as Factiva and corporate reports from EaaS service providers. Reports from various associations, such as International Energy Agency (IEA) and Invest India, have been referred to while conducting the research.

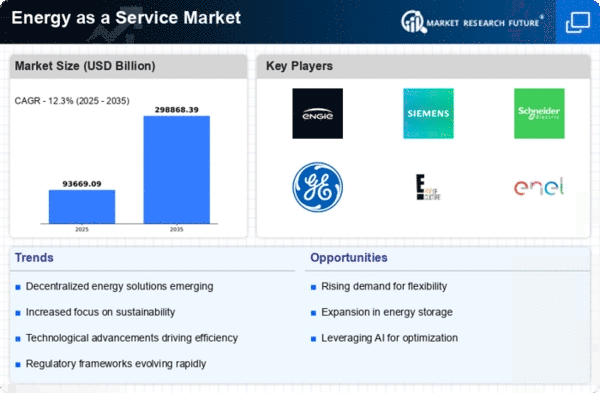

Market-Leading Players:

The leading players in the global EaaS market include Johnson Controls, Siemens, Schneider Electric, ENER-G, IRISys, ABB, ENGIE, Siemens, First Solar, Electric Power Research Institute (EPRI), and Vergnet.

Market Segmentation:

The global EaaS market has been segmented on the basis of application, service, end-user, and region.

By service, the global EaaS market has been further segmented into consulting services, operation and maintenance services, financial services, and other services.

By application, the global EaaS market has been segmented into residential, commercial and industrial.

By end-user, the global EaaS market has been further segmented into government, utilities, and other end-users.

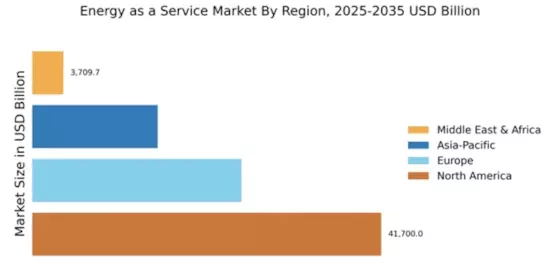

Regionally, the global EaaS market has been divided into regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape:

The major players operating in the global EaaS market have adopted various strategies to increase their market share. This includes acquisitions, innovations, mergers and acquisitions, and collaborations.

For instance, in June 2019, Johnson Controls collaborated with Spectral Energies to offer services under the spectrum of energy as a service in the United States.

In July 2018, Schneider Electric acquired Ineo, an energy expert from Mexico to increase its reach in the Mexican energy sector.

In June 2017, ENGIE, an energy expert from France, acquired up to 50% stake in IBT Holdings, a shareholder of Irisys Energy and Infrastructure Services.

In February 2017, Siemens acquired Adwen, a leader in offshore wind power and mobility solutions from German to expand its presence in the wind energy market.