Increased Focus on Patient Safety

The e prescribing-systems market is driven by an increased focus on patient safety and medication management. Healthcare organizations are prioritizing the reduction of medication errors, which can lead to adverse drug events and increased healthcare costs. E prescribing systems play a crucial role in mitigating these risks by providing features such as drug interaction checks, allergy alerts, and dosage recommendations. Studies indicate that implementing e prescribing can reduce medication errors by up to 70%, underscoring its importance in enhancing patient safety. As healthcare providers strive to improve quality of care, the demand for robust e prescribing solutions is likely to rise. This focus on safety not only benefits patients but also aligns with regulatory requirements, further solidifying the role of e prescribing systems in the healthcare ecosystem.

Regulatory Incentives for Adoption

The e prescribing-systems market is positively impacted by regulatory incentives aimed at promoting the adoption of electronic health technologies. Government initiatives, such as the Medicare Access and CHIP Reauthorization Act (MACRA), encourage healthcare providers to utilize e prescribing systems as part of their quality improvement efforts. These regulations often come with financial incentives, which can significantly offset the costs associated with implementing e prescribing solutions. As healthcare providers seek to comply with these regulations and maximize their reimbursement potential, the adoption of e prescribing systems is likely to increase. Furthermore, the ongoing push for interoperability among health information systems aligns with regulatory goals, further driving the demand for e prescribing solutions that can seamlessly integrate with existing healthcare technologies.

Growing Emphasis on Cost Efficiency

The e prescribing-systems market is also influenced by the growing emphasis on cost efficiency within healthcare organizations. As healthcare costs continue to rise, providers are seeking solutions that can streamline operations and reduce expenses. E prescribing systems contribute to cost savings by minimizing paperwork, reducing prescription errors, and enhancing workflow efficiency. According to industry estimates, implementing e prescribing can save healthcare organizations an average of $50,000 annually by decreasing administrative burdens and improving medication management. This financial incentive is likely to drive more healthcare facilities to adopt e prescribing solutions, thereby expanding the market. Additionally, the potential for improved patient outcomes through better medication adherence can lead to further cost reductions in the long term.

Rising Demand for Telehealth Services

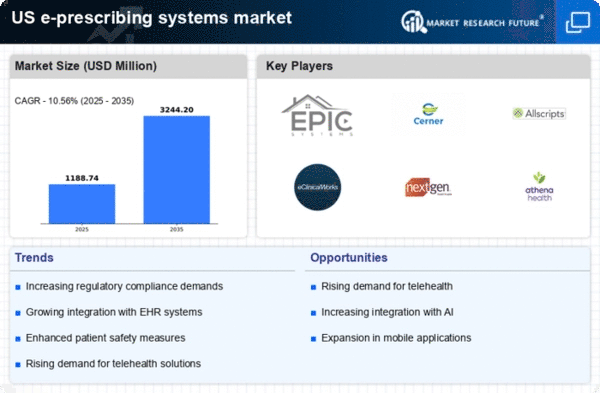

The e prescribing-systems market is significantly influenced by the rising demand for telehealth services. As healthcare providers increasingly adopt telemedicine, the need for efficient e prescribing solutions becomes more pronounced. Telehealth allows patients to consult with healthcare professionals remotely, necessitating a seamless prescription process that e prescribing systems can provide. According to recent data, telehealth visits have increased by over 50% in the past year, indicating a shift in patient preferences towards remote healthcare. This trend is likely to continue, further propelling the e prescribing-systems market. The ability to prescribe medications electronically during virtual consultations enhances the overall patient experience and ensures timely access to necessary medications, thereby reinforcing the importance of e prescribing systems in modern healthcare.

Technological Advancements in Healthcare

The e prescribing-systems market is experiencing a surge due to rapid technological advancements in healthcare. Innovations such as cloud computing, artificial intelligence, and machine learning are enhancing the capabilities of e prescribing systems. These technologies facilitate real-time data access, improve prescription accuracy, and streamline workflows for healthcare providers. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years. The integration of advanced analytics into e prescribing systems allows for better patient outcomes and reduced medication errors, which is crucial in a landscape where patient safety is paramount. Furthermore, the increasing adoption of mobile health applications is likely to drive the demand for e prescribing solutions, as they offer convenience and accessibility to both patients and providers.