Rising Focus on Cybersecurity Measures

As the digital fault-recorder market evolves, the rising focus on cybersecurity measures is becoming a critical driver. With the increasing integration of digital technologies in energy systems, the risk of cyber threats has escalated. Utilities are now prioritizing the protection of their monitoring systems against potential attacks. This heightened awareness is leading to the development of more secure digital fault recorders, which incorporate advanced encryption and security protocols. The market is likely to see a shift towards products that not only provide fault detection but also ensure data integrity and security, reflecting the industry's commitment to safeguarding critical infrastructure.

Growing Demand for Real-Time Data Analysis

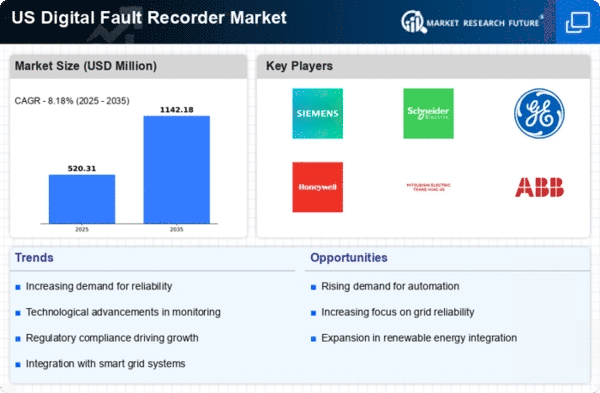

The digital fault-recorder market is witnessing a significant increase in demand for real-time data analysis capabilities. Utilities and energy companies are increasingly recognizing the importance of immediate fault detection and analysis to enhance grid reliability. This trend is driven by the need to minimize downtime and improve operational efficiency. According to recent data, the market for digital fault recorders is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of the industry's shift towards advanced monitoring solutions that provide actionable insights, thereby reinforcing the critical role of digital fault recorders in maintaining system integrity.

Regulatory Compliance and Standards Enforcement

Regulatory compliance and standards enforcement are pivotal factors influencing the digital fault-recorder market. As regulatory bodies establish stricter guidelines for monitoring and reporting electrical faults, utilities are compelled to adopt advanced fault-recording technologies. Compliance with these regulations is essential for avoiding penalties and ensuring operational safety. The digital fault-recorder market is expected to expand as utilities invest in systems that meet or exceed regulatory requirements. This trend is likely to drive market growth, with projections indicating that compliance-related investments could account for a significant portion of the overall market expenditure in the coming years.

Technological Advancements in Monitoring Equipment

Technological advancements are significantly influencing the digital fault-recorder market. Innovations in sensor technology and data processing capabilities are enabling more accurate and efficient fault detection. Enhanced features such as improved data storage and analysis tools are becoming standard in new models. The integration of artificial intelligence and machine learning into fault recorders is also emerging, allowing for predictive maintenance and reducing the likelihood of system failures. As a result, the market is expected to witness a substantial increase in adoption rates, with estimates suggesting a potential market value exceeding $500 million by 2030.

Increased Investment in Infrastructure Modernization

The digital fault-recorder market is benefiting from a rise in investments aimed at modernizing infrastructure across the United States. As aging electrical grids require upgrades, utilities are prioritizing the implementation of advanced monitoring systems. This modernization effort is essential for enhancing grid resilience and accommodating the growing demand for electricity. Government initiatives and funding programs aimed at improving energy infrastructure are further propelling this trend. It is estimated that investments in grid modernization could reach $100 billion over the next decade, creating a favorable environment for the digital fault-recorder market to thrive.