Ethical Considerations

Ethical concerns surrounding animal welfare are increasingly influencing the cultured meat market. Many consumers are becoming disenchanted with conventional meat production methods, which often involve inhumane treatment of animals. Cultured meat presents a solution by eliminating the need for animal slaughter, appealing to those who prioritize ethical consumption. Surveys indicate that approximately 60% of consumers are willing to try cultured meat if it is marketed as a humane alternative. This growing ethical consciousness is expected to drive demand for cultured meat products, as consumers seek to align their purchasing choices with their values. The cultured meat market may benefit from this shift, as it positions itself as a compassionate alternative to traditional meat.

Sustainability Concerns

The increasing awareness of environmental issues is driving the cultured meat market. Consumers are becoming more conscious of the ecological impact of traditional meat production, which contributes to deforestation, greenhouse gas emissions, and water scarcity. Cultured meat offers a more sustainable alternative, potentially reducing land use by up to 99% and water consumption by 90%. As a result, the cultured meat market is likely to see a surge in demand as consumers prioritize eco-friendly options. This shift in consumer behavior is expected to influence purchasing decisions, leading to a greater acceptance of cultured meat products. The industry's growth may also be supported by initiatives aimed at promoting sustainable food sources, further solidifying the position of cultured meat in the market.

Technological Innovations

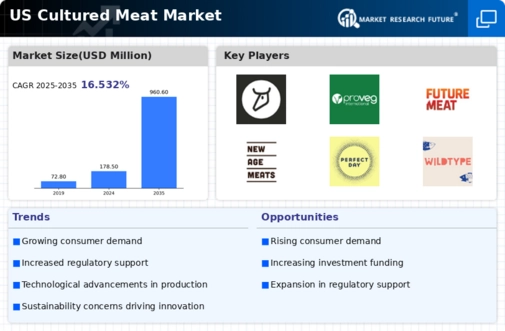

Advancements in biotechnology and food science are propelling the cultured meat market forward. Innovations in cell culture techniques, bioreactor design, and scaling production processes are enhancing the feasibility and efficiency of cultured meat production. For instance, recent developments have reduced production costs, making cultured meat more accessible to consumers. The market is expected to grow at a compound annual growth rate (CAGR) of 15% from 2025 to 2030, driven by these technological breakthroughs. As production becomes more efficient, the cultured meat market may witness a broader range of products, catering to diverse consumer preferences and dietary needs. This evolution in technology is likely to play a crucial role in shaping the future landscape of the industry.

Investment and Funding Growth

The cultured meat market is experiencing a surge in investment and funding, which is crucial for its development and expansion. Venture capital firms and private investors are increasingly recognizing the potential of cultured meat as a viable alternative to conventional meat. In 2025, investments in the cultured meat sector are projected to exceed $2 billion, reflecting a growing confidence in the industry's future. This influx of capital is likely to accelerate research and development efforts, enabling companies to innovate and scale production. As funding continues to grow, the cultured meat market may see an increase in product offerings and a reduction in costs, making it more competitive with traditional meat products.

Health and Nutrition Awareness

The rising focus on health and nutrition is significantly impacting the cultured meat market. As consumers become more informed about the nutritional content of their food, they are seeking alternatives that offer health benefits without compromising taste. Cultured meat can be engineered to contain lower levels of saturated fats and higher levels of beneficial nutrients, appealing to health-conscious individuals. Reports indicate that the market for alternative proteins, including cultured meat, is projected to reach $140 billion by 2029, reflecting a growing preference for healthier options. This trend suggests that the cultured meat market could capture a substantial share of the protein market as consumers increasingly prioritize their health and well-being.