Regulatory Compliance and Standards

Regulatory compliance is becoming increasingly critical in the construction sector, influencing the construction IoT market. Stricter regulations regarding safety, environmental impact, and data security are prompting construction firms to adopt IoT solutions that ensure compliance. For example, the implementation of IoT devices can facilitate adherence to safety standards by providing real-time data on site conditions. As of 2025, it is estimated that compliance-related expenditures in the construction industry could account for up to 15% of total project costs. This necessity for compliance drives the adoption of IoT technologies, positioning regulatory standards as a significant market driver.

Growing Demand for Data-Driven Insights

The construction IoT market is increasingly driven by the growing demand for data-driven insights. Companies are recognizing the value of data analytics in optimizing operations and enhancing decision-making processes. IoT devices collect vast amounts of data, which can be analyzed to identify trends, inefficiencies, and areas for improvement. In 2025, it is projected that data analytics will account for over 20% of the total investment in construction technologies. This shift towards data-centric approaches is likely to foster innovation and efficiency within the construction sector, making it a pivotal driver for the construction IoT market.

Enhanced Project Management Capabilities

The construction IoT market is significantly influenced by the demand for enhanced project management capabilities. IoT solutions provide construction managers with tools to monitor progress, allocate resources efficiently, and predict potential delays. By utilizing IoT technologies, companies can achieve up to a 30% reduction in project overruns, which is crucial in a competitive market. The ability to analyze data from various sources in real-time allows for informed decision-making, ultimately leading to improved project outcomes. As the industry continues to evolve, the emphasis on effective project management will likely propel the growth of the construction IoT market.

Technological Advancements in Construction

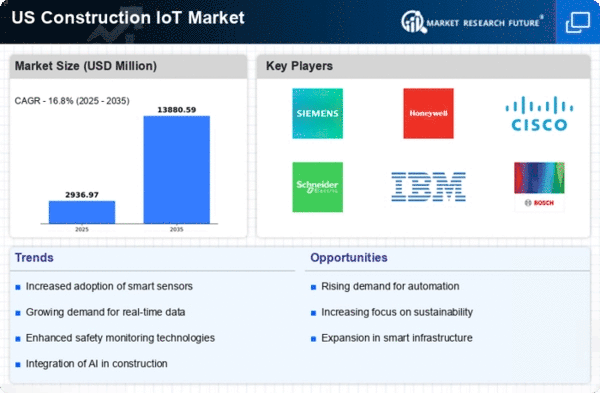

The construction IoT market is experiencing a surge due to rapid technological advancements. Innovations in sensor technology, data analytics, and cloud computing are transforming how construction projects are managed. For instance, the integration of IoT devices allows for real-time monitoring of equipment and materials, leading to enhanced efficiency and reduced costs. In 2025, the market is projected to reach approximately $20 billion, reflecting a compound annual growth rate (CAGR) of around 25% from previous years. This growth is driven by the need for improved project management and operational efficiency, making technological advancements a key driver in the construction IoT market.

Increased Focus on Sustainability Initiatives

Sustainability initiatives are becoming a prominent driver in the construction IoT market. As environmental concerns grow, construction companies are seeking ways to minimize their carbon footprint and enhance energy efficiency. IoT technologies facilitate the monitoring of energy consumption and waste management, enabling firms to implement sustainable practices. In 2025, it is anticipated that investments in sustainable construction technologies will exceed $10 billion, reflecting a shift towards greener practices. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious clients, thereby driving the adoption of IoT solutions in the construction industry.