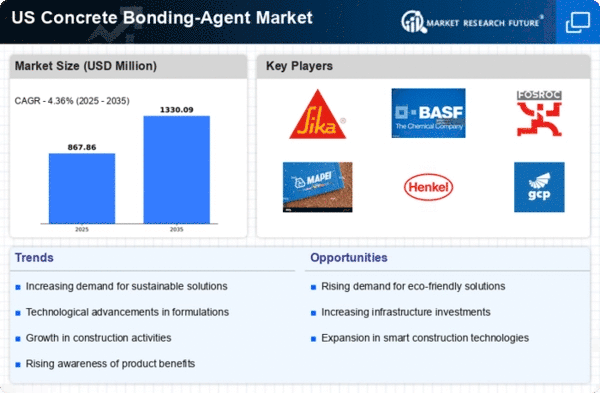

The concrete bonding-agent market is currently experiencing a dynamic phase. This phase is characterized by evolving consumer preferences and technological advancements. The demand for high-performance bonding agents is on the rise, driven by the increasing need for durable and long-lasting construction solutions. This trend is further fueled by the growing emphasis on sustainability, as manufacturers are exploring eco-friendly formulations that minimize environmental impact. Additionally, the expansion of infrastructure projects across various sectors, including residential, commercial, and industrial, is likely to bolster the market's growth. As stakeholders seek innovative products that enhance adhesion and improve overall structural integrity, the landscape of the concrete bonding-agent market appears poised for transformation.

Moreover, the competitive landscape is intensifying, with numerous players striving to differentiate their offerings through enhanced product features and superior performance. The integration of advanced technologies, such as nanotechnology and polymer chemistry, is becoming increasingly prevalent, enabling the development of bonding agents that exhibit exceptional strength and versatility. Furthermore, regulatory frameworks are evolving, prompting manufacturers to adapt their formulations to comply with stringent safety and environmental standards. This ongoing evolution suggests that the concrete bonding-agent market will continue to adapt and thrive in response to changing demands and technological innovations.

Sustainability Initiatives

There is a noticeable shift towards eco-friendly bonding agents within the concrete bonding-agent market. Manufacturers are increasingly focusing on developing products that utilize sustainable materials and processes, aiming to reduce the environmental footprint associated with construction activities. This trend aligns with broader industry efforts to promote green building practices and meet regulatory requirements.

Technological Advancements

The integration of advanced technologies is reshaping the concrete bonding-agent market. Innovations such as nanotechnology and polymer modifications are enhancing the performance characteristics of bonding agents, leading to improved adhesion and durability. These advancements are likely to attract a wider range of applications, further expanding market opportunities.

Infrastructure Development

The ongoing expansion of infrastructure projects is driving demand for the concrete bonding-agent market. As urbanization continues and investment in public works increases, the need for reliable bonding solutions becomes paramount. This trend suggests a robust growth trajectory for the market, as stakeholders seek high-quality products to support various construction initiatives.