Increased Focus on Preventive Healthcare

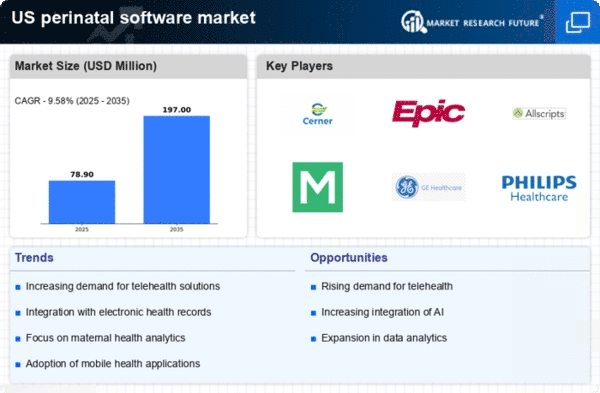

The clinical perinatal-software market is witnessing a shift towards preventive healthcare, driven by a growing emphasis on early intervention and risk assessment. Healthcare providers are increasingly adopting software solutions that facilitate proactive monitoring of maternal and fetal health. This trend is supported by research indicating that early detection of potential complications can significantly improve outcomes for both mothers and infants. As a result, clinical perinatal-software is being utilized to track health indicators, schedule regular check-ups, and provide educational resources to expectant mothers. The market is projected to grow as more healthcare systems recognize the value of preventive measures, potentially leading to a CAGR of 9% over the next few years.

Technological Advancements in Healthcare

Technological advancements play a pivotal role in shaping the clinical perinatal-software market. Innovations such as artificial intelligence (AI), machine learning, and data analytics are increasingly being integrated into perinatal software solutions. These technologies enable healthcare providers to analyze vast amounts of data, leading to more accurate predictions and personalized care plans for expectant mothers. For instance, AI algorithms can identify potential risks during pregnancy, allowing for timely interventions. The market for clinical perinatal-software is expected to reach $1 billion by 2027, driven by these technological enhancements. As healthcare systems continue to evolve, the demand for sophisticated software that leverages these advancements is likely to increase, further propelling market growth.

Rising Demand for Maternal Health Solutions

The clinical perinatal-software market experiences a notable increase in demand for maternal health solutions. This trend is driven by a growing awareness of maternal health issues and the need for improved prenatal care. According to recent data, approximately 700 women die each year in the US due to pregnancy-related complications, highlighting the urgency for effective monitoring and management tools. As healthcare providers seek to enhance maternal outcomes, the integration of clinical perinatal-software becomes essential. This software aids in tracking vital health metrics, managing patient data, and facilitating communication between healthcare professionals. The market is projected to grow at a CAGR of around 10% over the next five years, indicating a robust demand for innovative solutions that address the complexities of maternal health.

Growing Investment in Healthcare IT Infrastructure

Investment in healthcare IT infrastructure is a crucial driver for the clinical perinatal-software market. As healthcare organizations strive to enhance their technological capabilities, there is a marked increase in funding directed towards IT solutions that improve patient care. This investment is particularly evident in hospitals and clinics that are upgrading their systems to incorporate advanced clinical perinatal-software. The US healthcare IT market is expected to reach $500 billion by 2026, with a significant portion allocated to software that supports maternal health. Enhanced IT infrastructure not only facilitates better data management but also improves interoperability between different healthcare systems, thereby fostering a more integrated approach to maternal care.

Regulatory Support for Maternal Health Initiatives

Regulatory support significantly influences the clinical perinatal-software market. The US government has implemented various initiatives aimed at improving maternal health outcomes, such as the Maternal Health Initiative, which focuses on reducing maternal mortality rates. These initiatives often encourage the adoption of clinical perinatal-software by providing funding and resources to healthcare facilities. Additionally, regulatory bodies are increasingly recognizing the importance of data-driven solutions in enhancing maternal care. As a result, healthcare providers are more inclined to invest in software that complies with regulatory standards, ensuring better patient outcomes. This supportive regulatory environment is expected to contribute to a steady growth trajectory for the clinical perinatal-software market in the coming years.