Rising Geriatric Population

The US Cbct Dental Market is poised for growth due to the increasing geriatric population. As individuals age, they often experience a higher incidence of dental issues, necessitating advanced imaging techniques for effective diagnosis and treatment. CBCT technology is particularly beneficial for older patients, as it provides comprehensive imaging that aids in the management of complex dental conditions. According to the US Census Bureau, the population aged 65 and older is projected to reach 80 million by 2040, which will likely drive demand for dental services, including those utilizing CBCT imaging. This demographic shift presents a significant opportunity for growth within the US Cbct Dental Market.

Increased Focus on Preventive Dentistry

The US Cbct Dental Market is witnessing a shift towards preventive dentistry, which emphasizes early detection and intervention. CBCT imaging plays a crucial role in this paradigm by providing detailed three-dimensional images that facilitate the identification of dental issues before they escalate. As awareness of oral health continues to grow, dental professionals are increasingly utilizing CBCT technology to enhance diagnostic accuracy. The American Dental Association has reported that preventive services are becoming a standard part of dental care, which is likely to boost the demand for CBCT systems. This focus on prevention not only improves patient care but also contributes to the overall growth of the US Cbct Dental Market.

Technological Innovations and Advancements

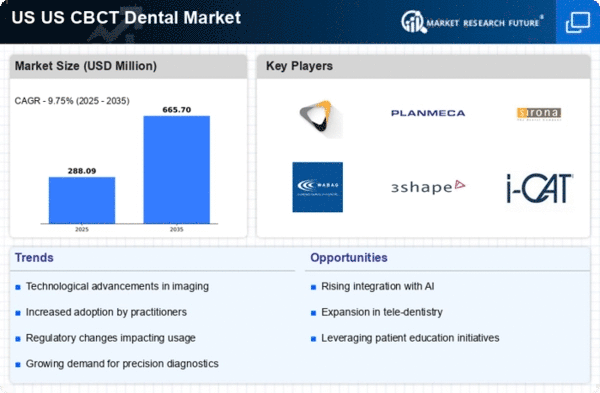

The US Cbct Dental Market is significantly influenced by ongoing technological innovations. Advancements in imaging technology, such as improved resolution and faster scanning times, are enhancing the capabilities of CBCT systems. These innovations enable dental professionals to obtain high-quality images with reduced radiation exposure, thereby addressing patient safety concerns. Furthermore, the integration of artificial intelligence in image analysis is streamlining diagnostic processes, making them more efficient. As a result, the market for CBCT systems is expected to expand, with projections indicating a growth rate of around 10% annually over the next few years. This trend underscores the importance of staying abreast of technological developments in the US Cbct Dental Market.

Expansion of Dental Practices and Facilities

The US Cbct Dental Market is benefiting from the expansion of dental practices and facilities across the country. As more dental professionals recognize the advantages of CBCT technology, there is a growing trend towards incorporating these systems into new and existing practices. This expansion is driven by the need for enhanced diagnostic capabilities and improved patient care. Additionally, the rise of dental service organizations (DSOs) is facilitating the adoption of CBCT systems, as these organizations often invest in advanced technologies to standardize care across multiple locations. The market is expected to see a steady increase in the number of dental practices equipped with CBCT technology, further propelling the growth of the US Cbct Dental Market.

Growing Demand for Minimally Invasive Procedures

The US Cbct Dental Market is experiencing a notable increase in demand for minimally invasive dental procedures. Patients are increasingly seeking treatments that reduce recovery time and discomfort, which has led to a rise in the adoption of Cone Beam Computed Tomography (CBCT) imaging. This technology allows for precise diagnostics and treatment planning, thereby enhancing patient outcomes. According to recent data, the market for minimally invasive dental procedures is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This trend is likely to drive the integration of CBCT technology in dental practices across the United States, as practitioners aim to meet patient expectations for less invasive treatment options.