Rising Healthcare Expenditure

The increasing healthcare expenditure in the United States is a significant driver for the bone biopsy market. As healthcare budgets expand, there is a greater allocation of resources towards advanced diagnostic procedures, including bone biopsies. The Centers for Medicare & Medicaid Services (CMS) reported that national health spending is projected to grow at an average rate of 5.4% annually. This growth is expected to reach nearly $6 trillion by 2027. This financial commitment to healthcare is likely to enhance access to diagnostic services, thereby increasing the utilization of bone biopsies. Furthermore, as insurance coverage expands and more patients seek timely diagnoses, the bone biopsy market is poised for growth. This trend underscores the importance of financial investment in healthcare as a catalyst for advancements in diagnostic capabilities.

Growing Awareness of Bone Health

There is a notable increase in public awareness regarding bone health, which is positively influencing the bone biopsy market. Educational campaigns and initiatives aimed at promoting bone health have led to a greater understanding of the importance of early diagnosis and treatment of bone diseases. As individuals become more informed about conditions such as osteoporosis and bone tumors, they are more likely to seek medical advice and diagnostic procedures, including bone biopsies. This heightened awareness is reflected in the rising number of screenings and consultations, contributing to the growth of the bone biopsy market. Additionally, healthcare providers are increasingly emphasizing the need for proactive bone health management, further driving the demand for accurate diagnostic tools. This trend suggests a favorable environment for the continued expansion of the bone biopsy market.

Advancements in Biopsy Techniques

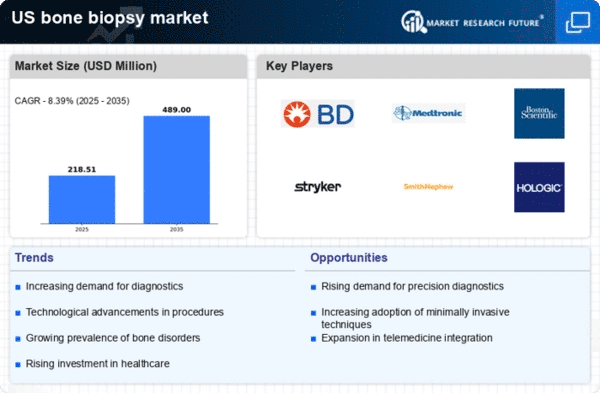

Innovations in biopsy techniques are playing a pivotal role in shaping the bone biopsy market. The introduction of technologies such as image-guided biopsies and needle biopsy systems has enhanced the precision and safety of the procedure. These advancements not only minimize patient discomfort but also improve diagnostic yield, making bone biopsies more appealing to both patients and healthcare providers. The market is witnessing a shift towards less invasive methods, which are associated with shorter recovery times and reduced complications. As a result, the adoption of these advanced techniques is expected to increase, potentially leading to a market growth rate of around 7% annually. This trend indicates a transformative phase for the bone biopsy market, as it adapts to the evolving needs of modern medicine.

Increasing Demand for Diagnostic Accuracy

The bone biopsy market is experiencing a notable surge in demand for diagnostic accuracy. As healthcare providers strive to enhance patient outcomes, the need for precise diagnostic tools becomes paramount. Bone biopsies are increasingly recognized for their ability to provide definitive diagnoses of various bone-related conditions, including malignancies and infections. This trend is reflected in the growing adoption of advanced imaging techniques and minimally invasive procedures, which are integral to the bone biopsy market. According to recent data, the market is projected to grow at a CAGR of approximately 6.5% over the next five years, driven by the increasing emphasis on accurate diagnostics in oncology and orthopedics. The rising awareness among healthcare professionals regarding the benefits of bone biopsies further propels this demand, indicating a robust future for the bone biopsy market.

Aging Population and Associated Health Issues

The demographic shift towards an aging population in the United States is significantly impacting the bone biopsy market. As individuals age, they become more susceptible to various bone diseases, including osteoporosis and bone cancers. This demographic trend is expected to drive the demand for bone biopsies, as early detection and accurate diagnosis are crucial for effective treatment. The U.S. Census Bureau projects that by 2030, approximately 20% of the population will be aged 65 and older, leading to an increased prevalence of bone-related health issues. Consequently, healthcare providers are likely to invest more in diagnostic procedures, including bone biopsies, to address the needs of this growing patient population. This shift suggests a promising outlook for the bone biopsy market, as it aligns with the broader trends in geriatric healthcare.