Growing Cyber Threat Landscape

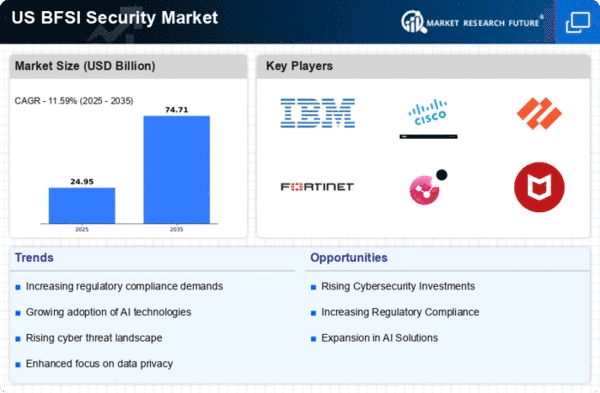

The bfsi security market is increasingly driven by the growing cyber threat landscape. Financial institutions face a myriad of cyber threats, including ransomware, phishing, and advanced persistent threats. In 2025, it is estimated that cybercrime will cost the financial sector over $6 trillion annually. This alarming trend compels organizations to invest heavily in security measures to protect sensitive data and maintain customer trust. As a result, the demand for advanced security solutions, such as intrusion detection systems and endpoint protection, is surging. The bfsi security market is expected to witness a compound annual growth rate (CAGR) of approximately 10% over the next five years, reflecting the urgency to bolster defenses against evolving cyber threats.

Shift Towards Cloud-Based Security Solutions

The shift towards cloud-based security solutions is transforming the bfsi security market. As financial institutions increasingly migrate to cloud environments, the demand for cloud security services is surging. In 2025, the cloud security market within the bfsi sector is expected to reach $20 billion, reflecting a CAGR of 12%. This transition is driven by the need for scalable, flexible, and cost-effective security solutions that can adapt to evolving threats. Cloud-based security services offer enhanced capabilities, such as real-time monitoring and automated threat response, which are essential for safeguarding sensitive financial data. As organizations embrace digital transformation, the bfsi security market is likely to benefit from this growing trend.

Regulatory Pressures and Compliance Requirements

Regulatory pressures are a critical driver of the bfsi security market. Financial institutions are subject to stringent regulations aimed at protecting consumer data and ensuring financial stability. Compliance with regulations such as the Gramm-Leach-Bliley Act (GLBA) and the Payment Card Industry Data Security Standard (PCI DSS) necessitates significant investments in security infrastructure. In 2025, it is projected that compliance-related expenditures will account for nearly 30% of total security budgets within the sector. This ongoing regulatory scrutiny compels organizations to adopt advanced security measures, thereby propelling growth in the bfsi security market as they seek to mitigate risks and avoid costly penalties.

Technological Advancements in Security Solutions

Technological advancements play a pivotal role in shaping the bfsi security market. Innovations such as biometric authentication, blockchain technology, and advanced encryption methods are revolutionizing how financial institutions secure transactions and customer data. For instance, the adoption of biometric solutions is projected to grow by 15% annually, as organizations seek to enhance security while improving user experience. Furthermore, the integration of artificial intelligence and machine learning into security systems enables real-time threat detection and response, significantly reducing the risk of breaches. As these technologies continue to evolve, they are likely to drive substantial investments in the bfsi security market, fostering a more secure financial ecosystem.

Rising Consumer Awareness and Demand for Security

Consumer awareness regarding data privacy and security is on the rise, significantly impacting the bfsi security market. As individuals become more informed about the risks associated with data breaches, they increasingly demand robust security measures from financial institutions. Surveys indicate that over 70% of consumers prioritize security features when choosing a financial service provider. This heightened awareness compels organizations to enhance their security protocols and invest in comprehensive security solutions. Consequently, the bfsi security market is likely to experience accelerated growth as institutions strive to meet consumer expectations and maintain competitive advantage in a crowded marketplace.