Cost Reduction Initiatives

Cost efficiency remains a pivotal driver in the aviation blockchain market. Airlines and service providers are under constant pressure to reduce operational costs while maintaining high service standards. Blockchain technology offers potential solutions by automating processes, reducing paperwork, and minimizing fraud. For instance, the implementation of smart contracts can streamline transactions, thereby cutting down administrative costs significantly. Reports suggest that companies adopting blockchain solutions could save up to 30% in operational costs over time. This financial incentive is compelling for stakeholders in the aviation sector, prompting increased investment in blockchain technologies. As the aviation blockchain market evolves, the focus on cost reduction is likely to catalyze further adoption and innovation, ultimately reshaping the financial landscape of the industry.

Enhanced Data Security Protocols

Data security is a paramount concern in the aviation blockchain market, particularly given the sensitive nature of passenger and operational data. The aviation industry is increasingly targeted by cyber threats, necessitating robust security measures. Blockchain technology inherently provides enhanced security features, such as encryption and decentralized data storage, which can significantly mitigate risks associated with data breaches. The market is witnessing a shift towards solutions that prioritize data integrity and security, with many stakeholders investing in blockchain systems to safeguard their information. It is estimated that the aviation blockchain market could see a 40% increase in demand for security-focused applications in the coming years. This emphasis on data security not only protects sensitive information but also builds consumer trust, which is essential for the industry's long-term viability.

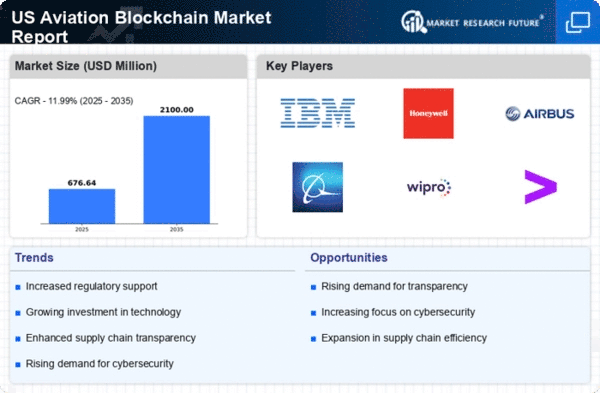

Increased Demand for Transparency

The aviation blockchain market is experiencing a notable surge in demand for transparency across various operations. Stakeholders, including airlines and regulatory bodies, are increasingly seeking solutions that provide real-time visibility into transactions and data flows. This demand is driven by the need to enhance trust among participants in the aviation ecosystem. According to recent estimates, the aviation blockchain market is projected to grow at a CAGR of approximately 25% over the next five years, indicating a robust interest in transparent systems. The ability to track aircraft maintenance records, cargo shipments, and passenger data securely and transparently is becoming a critical factor for operational efficiency. As transparency becomes a priority, the aviation blockchain market is likely to see innovations that cater to these needs, fostering a more accountable and reliable aviation environment.

Collaboration Among Industry Players

Collaboration is emerging as a key driver in the aviation blockchain market, as industry players recognize the benefits of working together to develop and implement blockchain solutions. Partnerships between airlines, technology providers, and regulatory agencies are becoming increasingly common, fostering innovation and knowledge sharing. This collaborative approach is essential for addressing the complex challenges faced by the aviation sector, such as supply chain inefficiencies and data management issues. By pooling resources and expertise, stakeholders can create more effective blockchain applications that enhance operational efficiency. The aviation blockchain market is likely to see a rise in joint ventures and consortiums aimed at advancing blockchain technology. Such collaborations not only facilitate the sharing of best practices but also help in establishing industry standards, which are crucial for the widespread adoption of blockchain solutions.

Regulatory Support and Framework Development

The aviation blockchain market is increasingly influenced by the development of supportive regulatory frameworks. As blockchain technology gains traction, regulatory bodies are recognizing the need to establish guidelines that facilitate its integration into aviation operations. This regulatory support is crucial for ensuring compliance and fostering innovation within the market. Recent initiatives by government agencies to explore blockchain applications in aviation suggest a proactive approach to regulation. For instance, the Federal Aviation Administration (FAA) has begun to assess blockchain's potential in enhancing safety and efficiency. Such regulatory advancements are likely to encourage investment and participation in the aviation blockchain market, as stakeholders seek to align with emerging standards and practices. The establishment of clear regulations could potentially accelerate the adoption of blockchain solutions, driving growth in the market.