Increased Regulatory Compliance

The automotive operating-system market is shaped by the increasing regulatory compliance requirements imposed by government agencies. In the US, regulations surrounding vehicle emissions, safety standards, and data privacy are becoming more stringent. As a result, automotive manufacturers are compelled to adopt advanced operating systems that can ensure compliance with these regulations. For instance, the implementation of software updates to address safety vulnerabilities is now a critical aspect of vehicle maintenance. This trend is likely to drive investment in automotive operating systems that can facilitate real-time monitoring and reporting, thereby enhancing overall vehicle safety and compliance. The need for adherence to regulatory standards is expected to bolster the automotive operating-system market as manufacturers seek to mitigate risks and avoid penalties.

Shift Towards Electric Vehicles

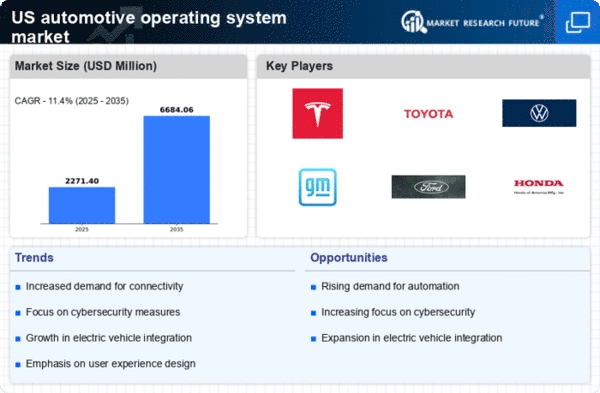

The automotive operating-system market is significantly influenced by the ongoing shift towards electric vehicles (EVs). As of 2025, EV sales in the US are projected to account for over 25% of total vehicle sales, reflecting a growing consumer preference for sustainable transportation options. This transition necessitates the development of specialized operating systems that can manage the unique requirements of electric drivetrains, battery management, and energy efficiency. Automotive manufacturers are increasingly focusing on software solutions that optimize vehicle performance and enhance user experience. The rise of EVs is expected to create new opportunities within the automotive operating-system market, as companies strive to innovate and differentiate their products in a competitive landscape.

Growing Connectivity and IoT Integration

The automotive operating-system market is increasingly influenced by the growing connectivity and integration of Internet of Things (IoT) technologies in vehicles. As of 2025, it is estimated that over 70% of new vehicles will feature some form of connectivity, enabling real-time data exchange between vehicles and external systems. This trend necessitates the development of sophisticated operating systems capable of managing vast amounts of data and ensuring seamless communication. Automotive manufacturers are investing in software solutions that enhance vehicle-to-everything (V2X) communication, which can improve traffic management and enhance safety. The rise of connected vehicles is likely to create new avenues for growth within the automotive operating-system market, as companies strive to leverage data for improved functionality and user experience.

Rising Demand for Advanced Driver Assistance Systems

The automotive operating-system market experiences a notable surge in demand for advanced driver assistance systems (ADAS). This trend is driven by increasing consumer expectations for safety and convenience features in vehicles. As of 2025, approximately 40% of new vehicles sold in the US are expected to be equipped with some form of ADAS. Consequently, automotive manufacturers are investing heavily in sophisticated operating systems that can support these technologies. The integration of features such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking necessitates robust software solutions. This growing emphasis on safety and automation is likely to propel the automotive operating-system market forward, as manufacturers seek to enhance their offerings and meet regulatory requirements.

Consumer Demand for Personalization and User Experience

The automotive operating-system market is significantly impacted by the rising consumer demand for personalization and enhanced user experience in vehicles. As consumers increasingly seek tailored solutions, automotive manufacturers are focusing on developing operating systems that allow for customizable interfaces and features. This trend is evident in the growing popularity of infotainment systems that integrate with smartphones and provide personalized content. By 2025, it is anticipated that nearly 60% of consumers will prioritize user-friendly interfaces and personalized features when purchasing a vehicle. This shift in consumer preferences is likely to drive innovation within the automotive operating-system market, as manufacturers strive to create engaging and intuitive experiences that resonate with their customers.