Customization Trends

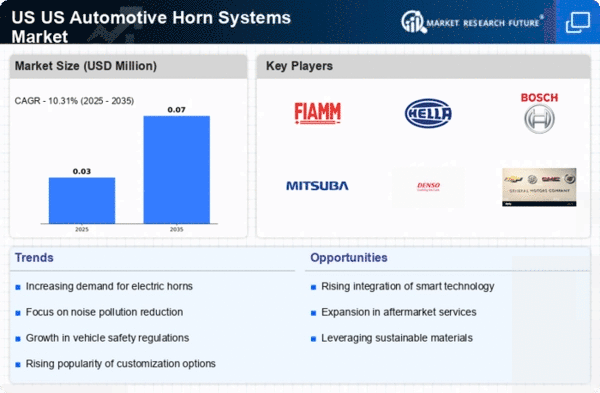

Customization trends are emerging as a significant driver in the US Automotive Horn Systems Market. Consumers are increasingly seeking personalized features in their vehicles, including unique horn sounds and designs. This trend is particularly prevalent among younger demographics who value individuality and self-expression. Manufacturers are responding to this demand by offering customizable horn systems that allow consumers to select different sounds or even create their own. This shift towards personalization not only enhances the consumer experience but also drives sales in the automotive sector. Additionally, the rise of aftermarket modifications has led to an increase in demand for specialized horn systems that cater to specific consumer preferences. As customization continues to gain traction, it is likely to play a vital role in shaping the future of the US Automotive Horn Systems Market.

Environmental Regulations

Environmental regulations are increasingly influencing the US Automotive Horn Systems Market. As the automotive sector faces mounting pressure to reduce noise pollution and improve sustainability, manufacturers are adapting their horn systems accordingly. The Environmental Protection Agency (EPA) has implemented stricter noise regulations, prompting manufacturers to develop quieter and more efficient horn systems. This shift not only aligns with regulatory requirements but also caters to the growing consumer demand for environmentally friendly vehicles. The integration of eco-friendly materials in horn production is becoming more common, as manufacturers seek to minimize their environmental footprint. Furthermore, the rise of electric vehicles, which typically operate more quietly, necessitates the development of innovative horn systems that comply with these regulations. Thus, environmental regulations serve as a significant driver for the US Automotive Horn Systems Market, shaping product development and market dynamics.

Rising Vehicle Production

The US Automotive Horn Systems Market is experiencing growth driven by the increasing production of vehicles. In recent years, the automotive sector has seen a resurgence, with manufacturers ramping up production to meet consumer demand. In 2025, the US automotive production reached approximately 12 million units, indicating a robust market environment. This surge in vehicle production directly correlates with the demand for automotive horn systems, as each vehicle requires a horn for safety and communication purposes. As manufacturers focus on enhancing vehicle features, the integration of advanced horn systems becomes essential, further propelling the market. The growth in electric vehicles (EVs) also contributes to this trend, as these vehicles require specialized horn systems to comply with safety regulations. Thus, the rising vehicle production serves as a significant driver for the US Automotive Horn Systems Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the US Automotive Horn Systems Market. Innovations in sound technology and materials have led to the development of more efficient and effective horn systems. For instance, the introduction of electronic horns has improved sound quality and reduced power consumption, making them more appealing to manufacturers. Additionally, advancements in integration with vehicle safety systems, such as collision avoidance technologies, have created a demand for more sophisticated horn systems. The market is also witnessing the emergence of smart horns that can connect to mobile applications, allowing for customization and enhanced functionality. As these technologies continue to evolve, they are likely to attract more consumers and manufacturers, thereby driving growth in the US Automotive Horn Systems Market. The potential for further innovation suggests a dynamic future for this segment.

Increased Focus on Vehicle Safety

The US Automotive Horn Systems Market is significantly influenced by the heightened focus on vehicle safety. Regulatory bodies and consumer advocacy groups are increasingly emphasizing the importance of safety features in vehicles, including horn systems. The National Highway Traffic Safety Administration (NHTSA) has established guidelines that mandate the use of effective horn systems to enhance road safety. As a result, manufacturers are compelled to invest in high-quality horn systems that meet these safety standards. The growing awareness among consumers regarding vehicle safety is also driving demand for advanced horn systems that provide better sound output and reliability. This trend is further supported by the increasing number of vehicles on the road, which necessitates effective communication between drivers. Consequently, the increased focus on vehicle safety serves as a crucial driver for the US Automotive Horn Systems Market.