Rising Vehicle Production

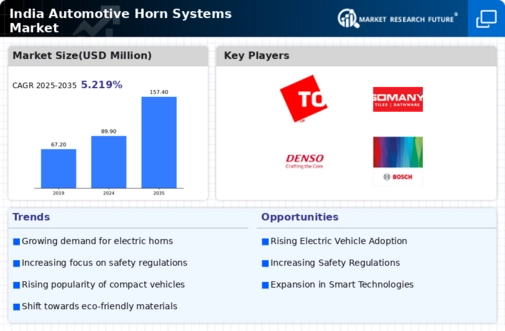

The India automotive horn systems market is experiencing a surge in demand due to the increasing production of vehicles. In recent years, India has emerged as one of the largest automobile manufacturers globally, with production figures reaching approximately 4.4 million units in 2022. This growth is driven by a combination of factors, including a burgeoning middle class, urbanization, and increased disposable income. As more vehicles are produced, the need for automotive horn systems becomes paramount, as these components are essential for safety and communication on the road. Consequently, manufacturers are likely to expand their production capacities to meet this rising demand, thereby propelling the growth of the automotive horn systems market in India.

Technological Innovations

The India automotive horn systems market is witnessing a wave of technological innovations that are reshaping product offerings. Manufacturers are increasingly integrating advanced technologies such as electronic horns and smart horn systems that can be controlled via mobile applications. These innovations not only enhance the functionality of horn systems but also improve user experience. For instance, the introduction of multi-tone horns and customizable sound options is gaining traction among consumers. As the automotive sector continues to evolve, the demand for technologically advanced horn systems is expected to rise, prompting manufacturers to invest in research and development. This trend is likely to bolster the automotive horn systems market in India, as consumers seek more sophisticated and versatile products.

Growing Awareness of Road Safety

The India automotive horn systems market is significantly influenced by the increasing awareness of road safety among consumers and regulatory bodies. With the rise in vehicular accidents, there is a heightened emphasis on safety features, including effective horn systems. The government has implemented various initiatives aimed at improving road safety, which includes promoting the use of high-quality automotive horns that comply with safety standards. This trend is likely to drive demand for advanced horn systems that offer better sound quality and reliability. As a result, manufacturers are expected to innovate and enhance their product offerings to align with these safety standards, thereby contributing to the growth of the automotive horn systems market in India.

Expansion of Electric Vehicle Market

The India automotive horn systems market is poised for growth due to the rapid expansion of the electric vehicle (EV) market. With the government's push for electric mobility and the aim to reduce carbon emissions, the number of electric vehicles on Indian roads is projected to increase significantly. As of 2025, the EV market is expected to account for around 30% of total vehicle sales in India. This shift towards electric vehicles necessitates the development of specialized horn systems that cater to the unique requirements of EVs, such as quieter operation and energy efficiency. Consequently, manufacturers are likely to adapt their product lines to meet these emerging needs, thereby driving growth in the automotive horn systems market.

Government Regulations and Standards

The India automotive horn systems market is heavily influenced by government regulations and standards aimed at ensuring vehicle safety and environmental compliance. The Ministry of Road Transport and Highways has established specific guidelines regarding the sound levels and quality of automotive horns. Compliance with these regulations is mandatory for manufacturers, which in turn drives the demand for high-quality horn systems that meet these standards. As regulatory frameworks continue to evolve, manufacturers are compelled to innovate and enhance their products to remain compliant. This dynamic creates opportunities for growth within the automotive horn systems market in India, as companies strive to develop products that not only meet regulatory requirements but also appeal to consumer preferences.