Rising Fuel Efficiency Standards

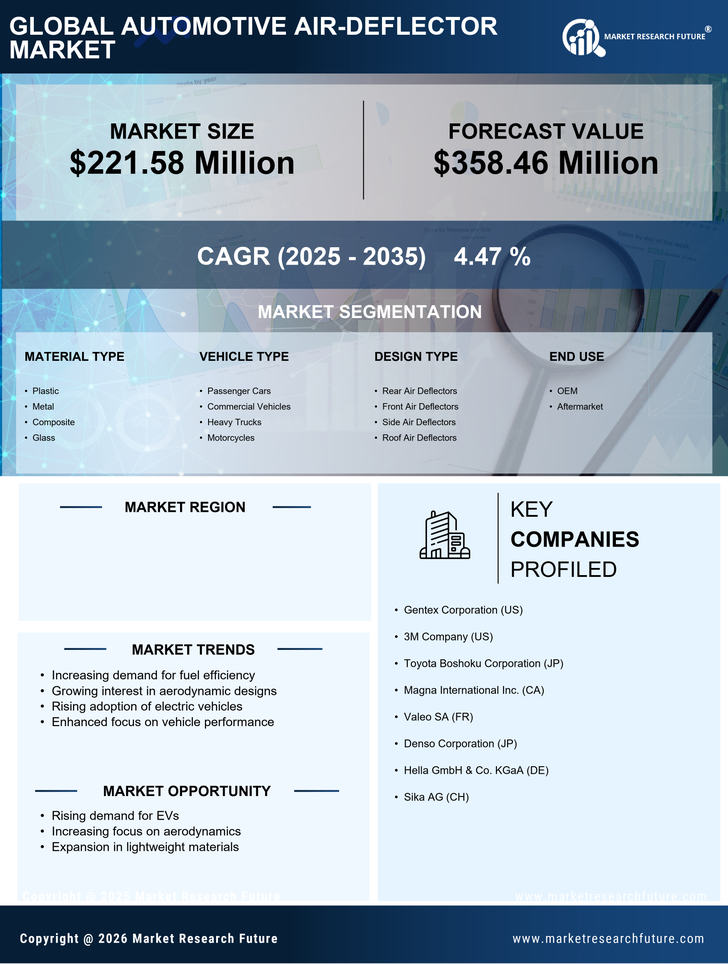

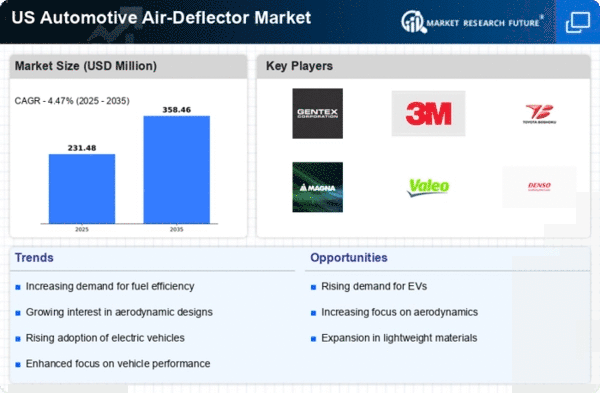

The automotive air-deflector market is experiencing growth due to the increasing fuel efficiency standards mandated by regulatory bodies in the US. These standards compel manufacturers to innovate and enhance vehicle aerodynamics, leading to a higher demand for air-deflectors. As vehicles are required to meet stricter emissions regulations, the integration of air-deflectors becomes essential in optimizing fuel consumption. The market is projected to grow at a CAGR of approximately 5.2% over the next five years, driven by these regulatory changes. Consequently, automotive manufacturers are investing in advanced air-deflector technologies to comply with these standards, thereby propelling the automotive air-deflector market forward.

Growth of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is significantly impacting the automotive air-deflector market. As these vehicles become more prevalent, there is an increasing need for aerodynamic enhancements to maximize their efficiency and range. Air-deflectors are essential in reducing drag, which is particularly important for electric vehicles that rely heavily on aerodynamics to extend battery life. The market for electric vehicles is expected to grow by over 20% annually, creating a substantial opportunity for air-deflector manufacturers. This shift towards electrification is likely to drive innovation in air-deflector designs, further propelling the automotive air-deflector market.

Technological Advancements in Materials

The automotive air-deflector market is benefiting from advancements in materials technology, which are enabling the production of lighter and more durable air-deflectors. Innovations such as the use of composite materials and advanced polymers are enhancing the performance and longevity of air-deflectors. These materials not only improve aerodynamics but also contribute to overall vehicle weight reduction, which is a critical factor in fuel efficiency. The market is witnessing a shift towards these high-performance materials, with a projected increase in their adoption rate by approximately 15% over the next few years. This trend indicates a strong potential for growth in the automotive air-deflector market as manufacturers seek to leverage these advancements.

Consumer Demand for Enhanced Performance

There is a notable shift in consumer preferences towards vehicles that offer improved performance and efficiency. This trend is significantly influencing the automotive air-deflector market, as consumers increasingly seek features that enhance vehicle aerodynamics. Air-deflectors play a crucial role in reducing drag and improving fuel economy, which aligns with consumer expectations for high-performance vehicles. Recent surveys indicate that nearly 70% of consumers prioritize fuel efficiency when purchasing a vehicle, further emphasizing the importance of air-deflectors in meeting these demands. As a result, automotive manufacturers are likely to incorporate advanced air-deflector designs to cater to this growing consumer base.

Increased Focus on Vehicle Customization

The automotive air-deflector market is also influenced by the growing trend of vehicle customization among consumers. As individuals seek to personalize their vehicles, the demand for aftermarket air-deflectors is on the rise. Custom air-deflectors not only enhance the aesthetic appeal of vehicles but also improve performance. Recent data suggests that the aftermarket segment of the automotive industry is projected to grow by 10% annually, indicating a robust opportunity for air-deflector manufacturers. This trend towards customization is likely to encourage innovation and diversification in the automotive air-deflector market, as manufacturers strive to meet the unique preferences of consumers.