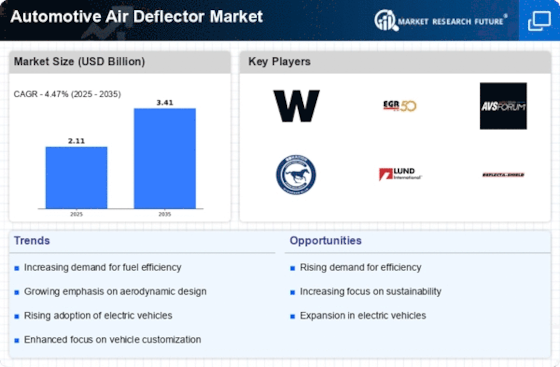

Rising Demand for Fuel Efficiency

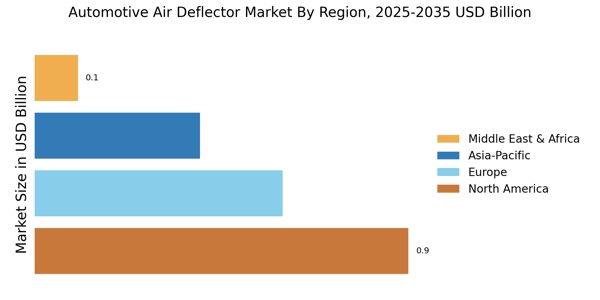

The Automotive Air Deflector Market is experiencing a notable surge in demand driven by the increasing consumer focus on fuel efficiency. As fuel prices remain volatile, consumers are more inclined to invest in vehicles that offer better mileage. Air deflectors play a crucial role in enhancing aerodynamics, thereby reducing drag and improving fuel economy. According to recent data, vehicles equipped with air deflectors can achieve fuel savings of up to 5%. This trend is particularly evident in the passenger vehicle segment, where manufacturers are integrating air deflectors into their designs to meet consumer expectations. Consequently, the Automotive Air Deflector Market is likely to witness sustained growth as automakers prioritize fuel-efficient technologies.

Growth of the Automotive Aftermarket

The Automotive Air Deflector Market is benefiting from the robust growth of the automotive aftermarket sector. As vehicle owners increasingly seek to personalize and enhance the performance of their vehicles, the demand for aftermarket accessories, including air deflectors, is on the rise. Market data indicates that the automotive aftermarket is projected to grow at a compound annual growth rate of over 4% in the coming years. This growth is fueled by a rising number of vehicle owners who are willing to invest in modifications that improve aesthetics and functionality. Consequently, the Automotive Air Deflector Market is likely to see increased sales as consumers turn to aftermarket solutions to enhance their driving experience.

Consumer Awareness of Vehicle Performance

Consumer awareness of vehicle performance is a pivotal factor driving the Automotive Air Deflector Market. As consumers become more informed about the benefits of vehicle modifications, there is a growing interest in products that enhance performance and efficiency. Air deflectors are recognized for their ability to improve aerodynamics, which can lead to better handling and fuel economy. Market Research Future suggests that consumers are increasingly seeking vehicles that not only meet their aesthetic preferences but also offer superior performance characteristics. This shift in consumer behavior is prompting manufacturers to incorporate air deflectors into their designs, thereby fueling growth in the Automotive Air Deflector Market. As awareness continues to rise, the demand for air deflectors is likely to increase.

Regulatory Pressure for Emission Reductions

Regulatory pressure for emission reductions is a significant driver for the Automotive Air Deflector Market. Governments worldwide are implementing stringent regulations aimed at reducing greenhouse gas emissions from vehicles. Air deflectors contribute to improved aerodynamics, which can lead to lower emissions and better fuel efficiency. As automakers strive to comply with these regulations, the integration of air deflectors into vehicle designs becomes increasingly important. This trend is particularly pronounced in regions with strict emission standards, where manufacturers are compelled to adopt technologies that enhance vehicle performance while minimizing environmental impact. As a result, the Automotive Air Deflector Market is expected to grow as compliance with regulatory frameworks becomes a priority for automakers.

Technological Advancements in Automotive Design

Technological advancements are significantly influencing the Automotive Air Deflector Market. Innovations in materials and design techniques have led to the development of more efficient and aesthetically pleasing air deflectors. For instance, the use of lightweight composites and advanced manufacturing processes has enabled the production of air deflectors that not only enhance vehicle performance but also contribute to overall vehicle weight reduction. This is particularly relevant as manufacturers strive to meet stringent emissions regulations. Furthermore, the integration of computational fluid dynamics in the design phase allows for precise optimization of air deflector shapes, enhancing their effectiveness. As these technologies continue to evolve, the Automotive Air Deflector Market is poised for further expansion.