US Antifreeze Coolant Market Summary

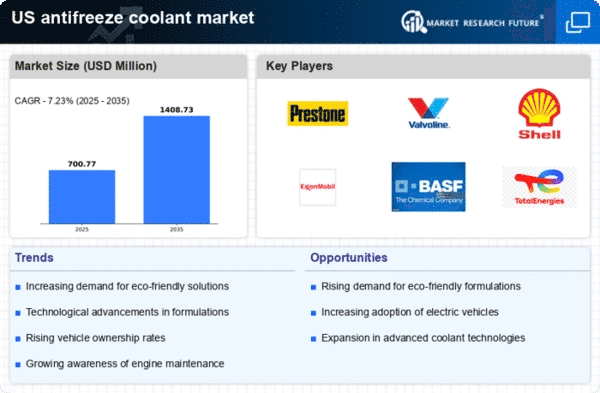

As per Market Research Future analysis, the US antifreeze coolant market size was estimated at 653.52 USD Million in 2024. The US antifreeze coolant market is projected to grow from 700.77 USD Million in 2025 to 1408.73 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US antifreeze coolant market is experiencing a transformative shift towards sustainability and advanced formulations.

- The market is witnessing a notable shift towards eco-friendly formulations, driven by increasing environmental awareness.

- Electric vehicles are impacting the coolant market, as they require specialized formulations to enhance efficiency.

- The largest segment remains the automotive sector, while the fastest-growing segment is anticipated to be heavy-duty vehicles.

- Rising automotive production and increased consumer awareness of vehicle maintenance are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 653.52 (USD Million) |

| 2035 Market Size | 1408.73 (USD Million) |

| CAGR (2025 - 2035) | 7.23% |

Major Players

Prestone Products Corporation (US), Valvoline Inc. (US), Shell Global (GB), ExxonMobil Corporation (US), BASF SE (DE), TotalEnergies SE (FR), Chevron Corporation (US), Fuchs Petrolub SE (DE), Motul S.A. (FR)