Growing Geriatric Population

The demographic shift towards an aging population in the United States is a crucial driver for the US Antifungal Treatment Market. Older adults are more susceptible to fungal infections due to age-related immunosuppression and comorbidities. The US Census Bureau projects that by 2030, approximately 20% of the US population will be aged 65 and older, creating a larger patient base for antifungal treatments. This demographic trend is prompting healthcare providers to focus on preventive measures and effective treatment options for fungal infections in older adults. Consequently, pharmaceutical companies are likely to invest in research and development tailored to this population, thereby expanding the antifungal treatment portfolio and addressing the specific needs of geriatric patients.

Rising Awareness of Fungal Infections

The US Antifungal Treatment Market is experiencing growth due to increasing awareness regarding fungal infections among healthcare professionals and the general public. Educational campaigns and initiatives by health organizations have highlighted the prevalence and potential severity of these infections. As a result, patients are more likely to seek medical attention, leading to higher diagnosis rates. This heightened awareness is particularly evident in immunocompromised populations, where fungal infections can be life-threatening. The CDC reports that invasive fungal infections affect approximately 1.5 million individuals annually in the US, underscoring the need for effective antifungal treatments. Consequently, pharmaceutical companies are responding to this demand by developing new antifungal agents, thereby expanding the market and improving patient outcomes.

Regulatory Support for Antifungal Research

The US Antifungal Treatment Market benefits from robust regulatory support aimed at fostering research and development in antifungal therapies. Agencies such as the FDA have established expedited pathways for the approval of novel antifungal agents, particularly those addressing unmet medical needs. This regulatory environment encourages pharmaceutical companies to invest in the development of innovative treatments. For instance, the FDA's Breakthrough Therapy designation has been granted to several antifungal drugs, facilitating faster access to the market. This supportive framework not only accelerates the availability of new treatments but also enhances competition within the market, ultimately benefiting patients with fungal infections. As a result, the US Antifungal Treatment Market is poised for continued growth.

Increased Incidence of Antifungal Resistance

The rising incidence of antifungal resistance is a pressing concern that is shaping the US Antifungal Treatment Market. As fungal pathogens evolve and develop resistance to existing antifungal agents, there is an urgent need for new and effective treatments. The CDC has reported a concerning increase in resistant strains of fungi, which complicates treatment options and poses significant challenges for healthcare providers. This situation is prompting increased investment in research focused on novel antifungal compounds and alternative treatment strategies. Pharmaceutical companies are likely to prioritize the development of new agents that can effectively combat resistant strains, thereby driving market growth. The urgency to address antifungal resistance is expected to catalyze innovation and expand the antifungal treatment landscape in the US.

Technological Advancements in Antifungal Treatments

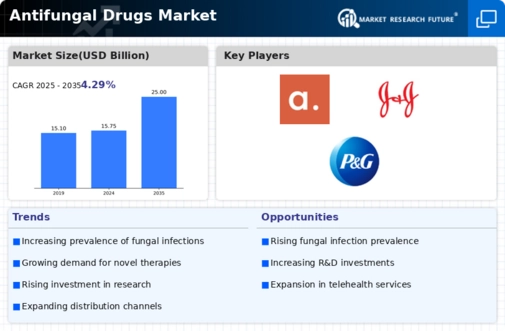

The US Antifungal Treatment Market is significantly influenced by technological advancements in drug development and delivery systems. Innovations such as nanotechnology and targeted drug delivery are enhancing the efficacy of antifungal treatments while minimizing side effects. For instance, the development of liposomal formulations has improved the bioavailability of antifungal agents, leading to better therapeutic outcomes. Furthermore, the integration of artificial intelligence in drug discovery is expediting the identification of new antifungal compounds. According to industry reports, the market for antifungal drugs is projected to reach USD 16 billion by 2026, driven by these technological advancements. As a result, healthcare providers are increasingly adopting these novel treatments, contributing to the overall growth of the market.