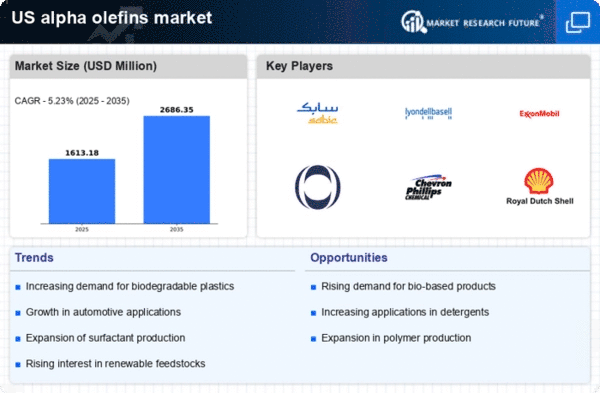

The alpha olefins market exhibits a dynamic competitive landscape characterized by robust growth drivers such as increasing demand for synthetic lubricants, surfactants, and plastics. Key players like LyondellBasell Industries (US), Chevron Phillips Chemical (US), and ExxonMobil (US) are strategically positioned to leverage their extensive production capabilities and technological advancements. LyondellBasell, for instance, focuses on innovation in polymer production, while Chevron Phillips emphasizes sustainable practices in its operations. These strategies collectively enhance their competitive edge, fostering a landscape where innovation and sustainability are paramount.The market structure appears moderately fragmented, with several key players influencing the competitive dynamics. Companies are increasingly localizing manufacturing to optimize supply chains and reduce operational costs. This tactic not only enhances responsiveness to market demands but also strengthens their foothold in regional markets. The collective influence of these major players shapes a competitive environment where agility and efficiency are critical for success.

In October Chevron Phillips Chemical (US) announced the expansion of its alpha olefins production facility in Texas, a move aimed at increasing capacity to meet rising demand. This strategic expansion underscores the company's commitment to maintaining a competitive edge through enhanced production capabilities. By investing in infrastructure, Chevron Phillips positions itself to capitalize on market growth while ensuring supply chain reliability.

In September LyondellBasell Industries (US) launched a new line of bio-based alpha olefins, reflecting a significant shift towards sustainable product offerings. This initiative not only aligns with global sustainability trends but also caters to the growing consumer preference for environmentally friendly products. The introduction of bio-based alternatives may enhance LyondellBasell's market share and appeal to a broader customer base.

In August ExxonMobil (US) entered a strategic partnership with a leading technology firm to integrate AI into its production processes. This collaboration aims to optimize operational efficiency and reduce costs through advanced analytics. The integration of AI technologies signifies a pivotal shift towards digital transformation in the alpha olefins market, potentially setting a new standard for operational excellence.

As of November the competitive trends in the alpha olefins market are increasingly defined by digitalization, sustainability, and technological integration. Strategic alliances are becoming more prevalent, fostering innovation and enhancing supply chain resilience. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and reliability in supply chains. Companies that successfully navigate these trends may secure a more prominent position in the market, ultimately shaping the future landscape of the alpha olefins sector.