Innovative Marketing Strategies

The almond milk market is witnessing a surge in innovative marketing strategies aimed at attracting a broader audience. Brands are increasingly utilizing social media platforms and influencer partnerships to promote their products, highlighting the health benefits and versatility of almond milk. In 2025, marketing expenditures in the almond milk market are expected to increase by 15%, reflecting the competitive landscape and the need for effective consumer engagement. This strategic focus on marketing not only enhances brand visibility but also educates consumers about the nutritional advantages of almond milk, potentially leading to increased sales and market share.

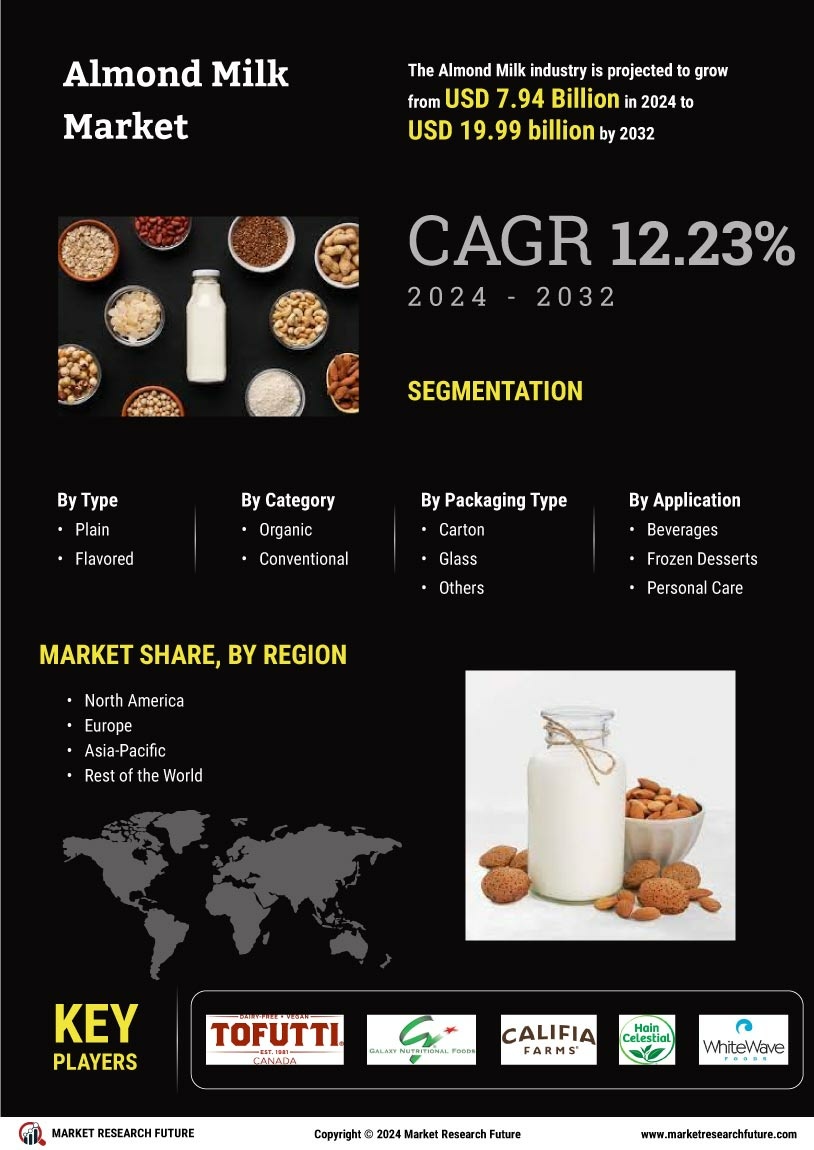

Rising Demand for Dairy Alternatives

The almond milk market is experiencing a notable increase in demand as consumers shift towards dairy alternatives. This trend is largely driven by a growing awareness of lactose intolerance and the health benefits associated with plant-based diets. In 2025, the almond milk market is projected to reach approximately $1.5 billion in the US, reflecting a compound annual growth rate (CAGR) of around 10% from previous years. This shift indicates a significant transformation in consumer preferences, as more individuals seek out non-dairy options that align with their dietary needs. The almond milk market is thus positioned to capitalize on this trend, catering to a diverse demographic that includes vegans, lactose-intolerant individuals, and health-conscious consumers.

Growing Interest in Nutritional Benefits

The almond milk market is experiencing heightened interest in the nutritional benefits associated with almond milk consumption. Consumers are becoming more informed about the advantages of almond milk, such as its low calorie content and high vitamin E levels. In 2025, it is projected that nearly 60% of consumers will actively seek out almond milk for its health benefits, indicating a shift towards more health-oriented purchasing decisions. This trend is likely to bolster the almond milk market, as brands emphasize the nutritional profiles of their products to attract health-conscious consumers. The focus on health benefits may also lead to the introduction of fortified almond milk options, further expanding the market.

Increased Availability in Retail Channels

The almond milk market is benefiting from enhanced distribution channels, making products more accessible to consumers. Major retailers and grocery chains are expanding their offerings of almond milk, which has led to a wider variety of brands and flavors available on shelves. In 2025, it is estimated that over 70% of grocery stores in the US will carry almond milk products, reflecting a significant increase in market penetration. This accessibility is crucial for the almond milk market, as it allows consumers to easily incorporate almond milk into their daily diets. The growth in retail presence not only boosts sales but also raises awareness about the benefits of almond milk, further driving consumer interest.

Environmental Awareness and Ethical Consumption

The almond milk market is increasingly influenced by rising environmental awareness among consumers. As individuals become more conscious of their ecological footprint, many are opting for plant-based alternatives like almond milk, which are perceived as more sustainable than traditional dairy products. In 2025, it is estimated that around 40% of consumers will choose almond milk based on its environmental benefits, such as lower greenhouse gas emissions and reduced water usage compared to dairy farming. This trend is likely to drive growth in the almond milk market, as brands that emphasize sustainable practices and ethical sourcing may gain a competitive edge in attracting environmentally conscious consumers.