Research Methodology on Almond Milk Market

1. Introduction:

Almond milk has become a popular alternative to cow’s milk due to its unique nutty and creamy flavour, and it can be used in a variety of meals and beverages. Almond milk is a dairy-free milk alternative made of ground almonds and water, and it provides many health benefits. For this reason, the demand for almond milk is increasing.

The objective of the research report is to analyze the market size of almond milk in different countries, including the United States, Canada, India, and Europe. The report will also present a market forecast of the growth in sales of almond milk.

2. Research Engagement Objectives:

- To analyze the factors that contribute to the growth in almond milk market size

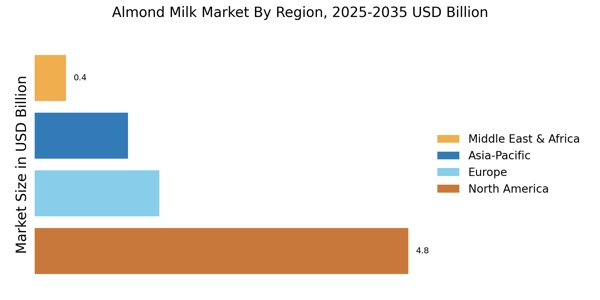

- To analyze the market size of almond milk in different countries

- To forecast market growth of almond milk in the coming years

3. Research Approach and Methodology:

The research approach used for this project is exploratory and descriptive in nature. The research will include the following steps:

Step 1: Collection and review of secondary data related to the almond milk market.

Step 2: Collection and review of primary data by conducting surveys and interviews with food manufacturers, distributors, retailers, and consumers.

Step 3: Analysis of the collected data and identification of trends and patterns.

Step 4: Development of a market forecast based on past data and present trends.

Step 5: Identification of issues and opportunities in the almond milk market.

4. Secondary Data Sources:

The secondary data sources used in this research include industry reports and articles, publications by trade associations and government bodies, company reports, regulatory documents, and industry databases such as Mintel, Euromonitor, Global Data, and Statista.

5. Primary Data Sources:

The primary data sources used in this research include surveys and interviews with food manufacturers, distributors, retailers, and consumers. The participants of the survey and interviews will be selected using the method of convenience sampling.

6. Data Analysis:

The data collected from the primary and secondary sources will be analyzed using quantitative and qualitative methods. The quantitative analysis will include the comparison of market size and growth in almond milk sales in different countries. The qualitative analysis will include the identification of issues and opportunities in the almond milk market.

7. Market Forecast:

The market forecast for 2023 to 2030 will be generated based on past data and present trends. The factors that will be taken into consideration for the forecast of the market size of almond milk include market trends, consumer spending, and product innovations.

8. Conclusion:

The research report will provide the most comprehensive analysis of the almond milk market in different countries. The report will include an analysis of the factors that contribute to the growth in sales of almond milk, the market size in different countries, and the market forecast for 2023 to 2030. The primary and secondary data sources used in this research, as well as the methods of data analysis and market forecasting, will be described in detail in the report.