Regulatory Support

Regulatory support plays a crucial role in the growth of the US Aircraft Synthetic Vision System Market. The Federal Aviation Administration (FAA) has established guidelines and standards that promote the adoption of synthetic vision systems in commercial aviation. These regulations are designed to improve safety and operational efficiency, thereby encouraging manufacturers to invest in the development of advanced synthetic vision technologies. The FAA's commitment to enhancing aviation safety through the integration of innovative technologies is evident in its ongoing initiatives. As a result, the market is expected to witness a steady increase in demand for synthetic vision systems, particularly as airlines and operators seek to comply with evolving safety regulations.

Technological Advancements

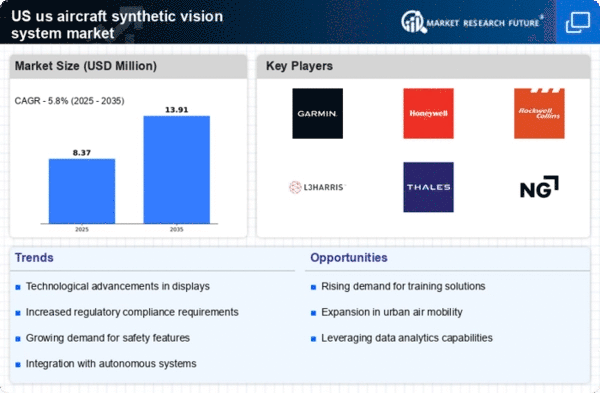

The US Aircraft Synthetic Vision System Market is experiencing rapid technological advancements that enhance the capabilities of synthetic vision systems. Innovations in sensor technology, data processing, and display systems are driving the market forward. For instance, the integration of artificial intelligence and machine learning algorithms into synthetic vision systems allows for improved situational awareness and decision-making. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements. Furthermore, the development of high-resolution displays and augmented reality interfaces is likely to enhance pilot training and operational efficiency, making synthetic vision systems more appealing to both commercial and military aviation sectors.

Focus on Safety Enhancements

The US Aircraft Synthetic Vision System Market is significantly influenced by the growing focus on safety enhancements in aviation. Airlines, manufacturers, and regulatory bodies are increasingly prioritizing technologies that improve flight safety and reduce accidents. Synthetic vision systems provide pilots with enhanced situational awareness, allowing for better decision-making during critical phases of flight. The National Transportation Safety Board (NTSB) has emphasized the importance of adopting advanced technologies to mitigate risks associated with aviation operations. As a result, the market is likely to see increased investments in synthetic vision systems, as stakeholders recognize their potential to enhance safety and operational reliability in both commercial and military aviation.

Growing Commercial Aviation Sector

The US Aircraft Synthetic Vision System Market is benefiting from the growth of the commercial aviation sector. As air travel demand continues to rise, airlines are increasingly investing in advanced avionics to enhance safety and operational efficiency. Synthetic vision systems are becoming a vital component of modern aircraft, providing pilots with critical information about terrain, obstacles, and weather conditions. According to industry forecasts, the commercial aviation market is expected to expand at a CAGR of around 6% over the next five years, which will likely drive the demand for synthetic vision systems. Airlines are recognizing the value of these systems in reducing pilot workload and improving flight safety, further propelling market growth.

Increased Demand in Military Applications

The US Aircraft Synthetic Vision System Market is witnessing a surge in demand for synthetic vision systems within military applications. The need for enhanced situational awareness and operational effectiveness in complex environments is driving military organizations to adopt advanced synthetic vision technologies. The US Department of Defense has recognized the importance of these systems in improving mission success rates and reducing risks to personnel. Recent reports indicate that military spending on advanced avionics, including synthetic vision systems, is projected to increase significantly over the next few years. This trend is likely to bolster the market, as defense contractors and military agencies prioritize investments in cutting-edge technologies to maintain operational superiority.