Increasing Air Traffic Demand

The aircraft docking-systems market is experiencing growth driven by the rising demand for air travel in the United States. As more passengers opt for air transportation, airlines are expanding their fleets, necessitating efficient docking systems to manage increased aircraft movements. According to the Federal Aviation Administration (FAA), air traffic is projected to grow by approximately 3.5% annually over the next decade. This surge in air traffic places pressure on airport infrastructure, prompting investments in advanced docking systems to enhance operational efficiency. Consequently, the aircraft docking-systems market is likely to benefit from this trend, as airports seek to optimize their facilities to accommodate a higher volume of aircraft while ensuring safety and reducing turnaround times.

Focus on Operational Efficiency

The aircraft docking-systems market is increasingly driven by a focus on operational efficiency among airlines and airport operators. As competition intensifies in the aviation sector, stakeholders are seeking ways to reduce costs and improve turnaround times. Efficient docking systems play a crucial role in achieving these objectives by minimizing the time aircraft spend on the ground. Airlines are investing in advanced docking technologies that facilitate quicker and safer aircraft handling, which can lead to increased profitability. Market analysis suggests that the emphasis on operational efficiency will continue to shape the aircraft docking-systems market, as stakeholders strive to enhance their service offerings and maintain a competitive edge.

Investment in Airport Infrastructure

The aircraft docking-systems market is poised for growth due to substantial investments in airport infrastructure across the United States. Federal and state governments, along with private stakeholders, are allocating significant funds to modernize airport facilities, which includes upgrading docking systems. The FAA has earmarked billions of dollars for airport improvement projects, emphasizing the need for efficient and reliable aircraft handling solutions. This influx of capital is expected to drive the demand for advanced docking systems that can accommodate larger aircraft and enhance operational efficiency. As airports expand and modernize, the aircraft docking-systems market is likely to see a corresponding increase in demand for innovative solutions.

Technological Integration and Automation

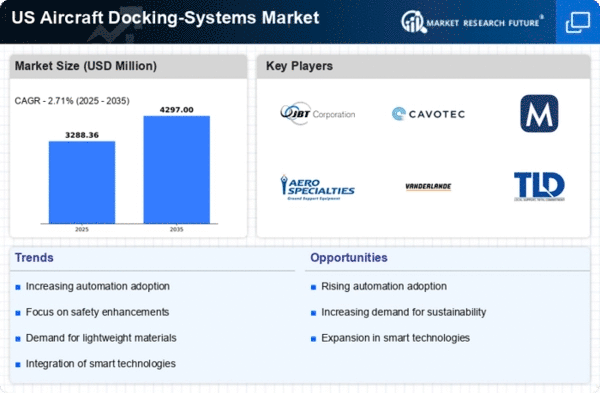

The integration of advanced technologies and automation in the aircraft docking-systems market is reshaping operational efficiencies within the aviation sector. Airports are increasingly adopting automated docking systems that utilize sensors, artificial intelligence, and real-time data analytics to streamline aircraft movements. This technological shift not only enhances the accuracy of docking procedures but also reduces the time required for aircraft turnaround. The market for automated docking systems is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 5% over the next five years. As airlines and airports seek to improve their operational capabilities, the demand for technologically advanced docking systems is likely to rise, further propelling the aircraft docking-systems market.

Regulatory Compliance and Safety Standards

The aircraft docking-systems market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities in the United States. The FAA and other regulatory bodies mandate that airports and airlines adhere to specific safety protocols, which include the implementation of advanced docking systems. These systems are designed to minimize the risk of accidents during aircraft handling and ensure the safety of ground personnel. As regulations evolve, the demand for innovative docking solutions that meet these requirements is expected to rise. This trend indicates a robust growth trajectory for the aircraft docking-systems market, as stakeholders prioritize safety and compliance in their operational strategies.