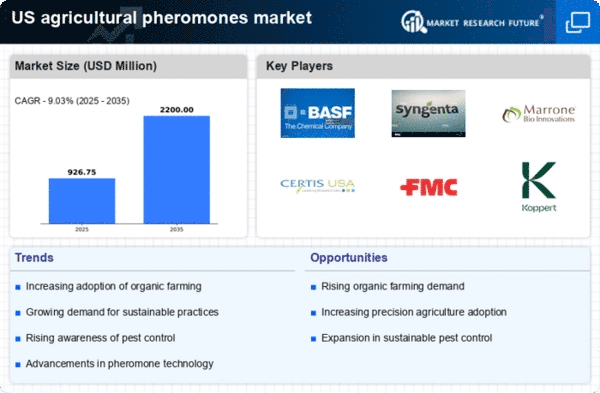

The agricultural pheromones market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable agricultural practices and the need for effective pest management solutions. Key players such as BASF SE (DE), Syngenta AG (CH), and Marrone Bio Innovations Inc (US) are strategically positioned to leverage innovation and technological advancements. BASF SE (DE) focuses on integrating digital solutions into its product offerings, enhancing precision agriculture capabilities. Meanwhile, Syngenta AG (CH) emphasizes partnerships with local farmers to tailor solutions that meet specific regional pest challenges, thereby strengthening its market presence. Collectively, these strategies contribute to a competitive environment that prioritizes sustainability and technological integration.In terms of business tactics, companies are increasingly localizing manufacturing to reduce supply chain vulnerabilities and enhance responsiveness to market demands. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on research and development initiatives. This collective influence of key players fosters a competitive atmosphere that encourages innovation and efficiency.

In October Marrone Bio Innovations Inc (US) announced a strategic partnership with a leading agricultural technology firm to develop next-generation pheromone-based pest control solutions. This collaboration is expected to enhance the efficacy of their products while also expanding their market reach. The strategic importance of this partnership lies in its potential to combine cutting-edge technology with biological pest management, positioning Marrone Bio Innovations Inc (US) as a frontrunner in sustainable agriculture.

In September Syngenta AG (CH) launched a new line of pheromone traps designed specifically for the North American market, aimed at combating invasive pest species. This product introduction not only showcases Syngenta's commitment to innovation but also reflects its strategic focus on addressing regional pest issues. The launch is likely to strengthen Syngenta's competitive edge by providing farmers with effective tools to manage pest populations sustainably.

In August BASF SE (DE) expanded its pheromone product portfolio through the acquisition of a niche player specializing in pheromone technology. This acquisition is indicative of BASF's strategy to enhance its product offerings and solidify its market position. By integrating this technology, BASF SE (DE) aims to provide comprehensive pest management solutions that align with the growing demand for environmentally friendly agricultural practices.

As of November current competitive trends in the agricultural pheromones market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) into pest management solutions. Strategic alliances among key players are shaping the landscape, fostering innovation and collaborative research efforts. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainable practices, reflecting the industry's shift towards more responsible agricultural solutions.