Increased Investment in Aerospace R&D

The US Aerospace Foams Market is benefiting from increased investment in research and development (R&D) within the aerospace sector. Government initiatives and private sector funding are being directed towards innovative materials and technologies that enhance aircraft performance and sustainability. For instance, the US government has allocated substantial resources to support aerospace R&D, which is likely to foster the development of advanced foam materials that meet the evolving needs of the industry. This influx of investment is expected to stimulate growth in the US Aerospace Foams Market, as manufacturers leverage new findings to create high-performance foams that align with the industry's focus on efficiency and environmental responsibility. The collaboration between academia, industry, and government entities is also anticipated to yield breakthroughs that further propel the market forward.

Growing Demand for Lightweight Materials

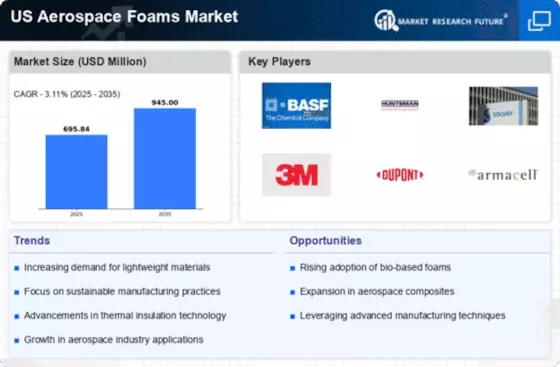

The US Aerospace Foams Market is experiencing a notable increase in demand for lightweight materials, driven by the aerospace sector's ongoing quest for fuel efficiency and performance enhancement. Lightweight foams, such as polyurethane and polyethylene, are increasingly utilized in aircraft interiors and structural components. According to recent data, the aerospace industry in the US is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2028, which is likely to further bolster the demand for aerospace foams. This trend is particularly evident in commercial aviation, where manufacturers are seeking to reduce overall aircraft weight to improve fuel economy and reduce emissions. Consequently, the US Aerospace Foams Market is poised to benefit from this shift towards lightweight materials, as manufacturers innovate to meet these evolving requirements.

Rising Demand for Aircraft Modernization

The US Aerospace Foams Market is witnessing a surge in demand for aircraft modernization, as airlines and manufacturers seek to upgrade existing fleets to improve efficiency and passenger experience. This trend is particularly pronounced in the commercial aviation sector, where older aircraft are being retrofitted with modern materials, including advanced foams that enhance comfort and reduce weight. The Federal Aviation Administration (FAA) has also encouraged modernization efforts through various initiatives aimed at improving operational efficiency and safety. As airlines invest in upgrading their fleets, the demand for high-quality aerospace foams is expected to rise, thereby driving growth in the US Aerospace Foams Market. This modernization trend not only supports the industry's economic viability but also aligns with broader sustainability goals.

Regulatory Compliance and Safety Standards

The US Aerospace Foams Market is significantly influenced by stringent regulatory compliance and safety standards imposed by organizations such as the Federal Aviation Administration (FAA) and the National Aeronautics and Space Administration (NASA). These regulations necessitate the use of high-performance foams that meet specific fire resistance, durability, and environmental impact criteria. As a result, manufacturers are compelled to invest in research and development to create foams that not only comply with these regulations but also enhance overall aircraft safety. The increasing focus on passenger safety and environmental sustainability is likely to drive innovation within the US Aerospace Foams Market, as companies strive to develop advanced materials that align with regulatory expectations while also meeting the demands of modern aerospace applications.

Technological Innovations in Foam Production

Technological advancements in foam production processes are playing a pivotal role in shaping the US Aerospace Foams Market. Innovations such as 3D printing and advanced polymerization techniques are enabling manufacturers to create foams with enhanced properties, including improved thermal insulation, sound absorption, and structural integrity. These advancements are particularly relevant in the context of the aerospace sector, where performance and reliability are paramount. The integration of smart materials and nanotechnology into foam production is also gaining traction, potentially leading to the development of next-generation aerospace foams. As these technologies continue to evolve, they are expected to drive growth in the US Aerospace Foams Market, allowing manufacturers to offer customized solutions that meet the specific needs of aerospace applications.