Growing Demand for Energy Efficiency

The US Advanced Metering Infrastructure Market is experiencing a notable surge in demand for energy efficiency solutions. As consumers become increasingly aware of their energy consumption patterns, utilities are compelled to adopt advanced metering technologies that facilitate real-time monitoring and management. According to the US Energy Information Administration, energy efficiency measures could potentially reduce electricity consumption by 10 to 30 percent. This trend is further supported by state-level initiatives aimed at promoting energy conservation, which encourages utilities to invest in smart meters and related infrastructure. Consequently, the integration of advanced metering systems not only enhances operational efficiency but also aligns with national goals for reducing greenhouse gas emissions, thereby driving growth in the US Advanced Metering Infrastructure Market.

Rising Consumer Awareness and Engagement

Consumer awareness regarding energy consumption is on the rise, significantly impacting the US Advanced Metering Infrastructure Market. As individuals seek to reduce their energy bills and carbon footprints, they are increasingly turning to smart meters that provide detailed insights into their energy usage. This heightened engagement encourages consumers to adopt energy-saving practices, which in turn drives demand for advanced metering solutions. Utilities are responding by offering programs that educate consumers about their energy consumption patterns and the benefits of smart metering. The result is a more informed customer base that actively participates in energy management, thereby fostering growth in the US Advanced Metering Infrastructure Market.

Government Incentives and Regulatory Frameworks

The US Advanced Metering Infrastructure Market is significantly influenced by government incentives and regulatory frameworks that promote the adoption of smart grid technologies. Federal and state policies, such as the Energy Policy Act, encourage utilities to invest in advanced metering systems by providing financial incentives and grants. These initiatives aim to modernize the electrical grid, enhance reliability, and improve energy efficiency. As of January 2026, several states have implemented mandates requiring utilities to deploy smart meters, further propelling market growth. The regulatory environment not only fosters innovation but also ensures that utilities can recover their investments in advanced metering infrastructure, thereby solidifying the market's expansion in the US Advanced Metering Infrastructure Market.

Technological Advancements in Metering Solutions

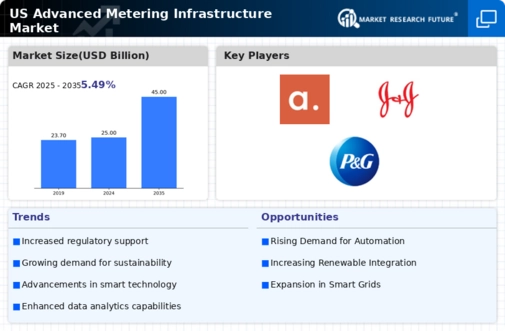

Technological innovations are significantly shaping the US Advanced Metering Infrastructure Market. The advent of smart meters, which offer two-way communication between utilities and consumers, has revolutionized the way energy is consumed and managed. These devices enable real-time data collection and analysis, allowing for more accurate billing and improved demand response strategies. The market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by advancements in Internet of Things (IoT) technologies and data analytics. Furthermore, the integration of artificial intelligence in metering solutions enhances predictive maintenance and operational efficiency, making it a critical driver for the US Advanced Metering Infrastructure Market.

Integration of Electric Vehicles and Charging Infrastructure

The growing adoption of electric vehicles (EVs) is poised to influence the US Advanced Metering Infrastructure Market significantly. As the number of EVs on the road increases, the demand for charging infrastructure and smart metering solutions that can manage energy distribution effectively becomes critical. Utilities are exploring advanced metering technologies to facilitate the integration of EV charging stations into the grid, ensuring that energy supply meets the rising demand. This trend is supported by federal initiatives aimed at expanding EV infrastructure, which could potentially lead to a market growth rate of 15% in the coming years. The interplay between EV adoption and advanced metering systems presents a unique opportunity for innovation within the US Advanced Metering Infrastructure Market.